The coronavirus lockdown has certainly impacted on how we have been living. You’ve probably had to get to grips with video meetings, find new and imaginative ways of socialising remotely, and even learn how to cut your own hair in the mirror.

It’s perhaps not surprising that recent research shows that the pandemic has made many investors more risk-averse. It reveals that 44% of those surveyed said they have become more cautious about financial decision making during the pandemic, with 42% saying they have put off major investment decisions until Covid is over.

While this is understandable, reducing risk means reducing your potential for growth, and there could be situations where doing this may not be the right thing to do.

Read on to learn more about risk and when maintaining a higher level may be more appropriate for you.

All investments are exposed to risk, it’s a question of how much

Even “low-risk” investments have an element of risk, as without it there can be no potential growth.

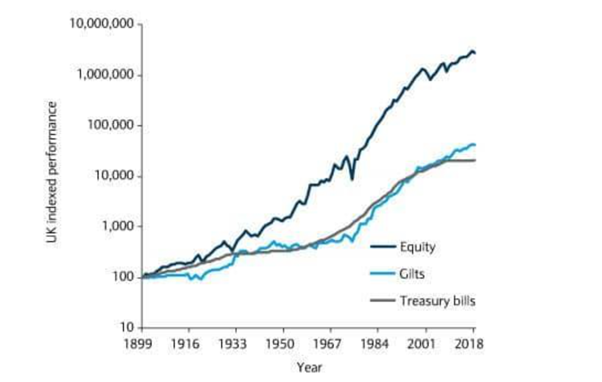

This is because the higher-risk element of investments, typically stocks and shares, are the element that offers most growth potential over the long-term. The trade-off is that stocks and shares – which are also known as “equities” – have greater potential to lose value, for example if the markets take a downturn.

Other higher-risk funds include futures and options, which allow an investor to buy shares at a specific price at a specific date. The investor then hopes the market will move in a way that allows them to make a profit.

Lower-risk funds include government bonds – also known as “Gilts” or Treasury Bills. These are a loan to a government for a set period. At the end of the agreed time, you get your original amount back, yet during the period you receive interest payments known as “coupons”.

Other lower-risk funds in an investment may include commercial property, where the investor is looking for the value of the capital to grow but also to generate an income through rent.

As you can see from the below graph taken from the Barclays Gilt Study, over the long-term stocks and shares (equities) provide greater growth, despite downturns along the way. The study followed the nominal performance of £100 invested in bonds or equities between 1899 and 2019.

Source: Barclays Equity Gilt Study

A high-risk fund may contain 70% higher-risk investments, while a low-risk fund may contain around 25%. Investment companies usually offer several investments with varying levels of risk, for example, a 35-40% exposure to higher-risk funds.

If you’re investing for the long term, higher-risk investments could be more appropriate

If you have more than 10 years to invest, higher-risk funds could be more attractive as they expose your money to greater growth potential.

So, if you are investing in a Stocks and Shares ISA to use later in life, or want to invest for your children, it’s possible that a higher-risk fund could be more appropriate. The same may apply if you have high levels of capital that means you will not need to access the money invested for 10 years or more.

Pensions could also be better in higher-risk funds

If you are an investor building your pension in your 20s, 30s or 40s, a strategy you may want to consider could be to put contributions into higher-risk funds. This exposes your money to greater growth potential.

Remember, you’ll be relying on your pension to fund your retirement, which could last for decades. Exposing your contributions to greater long-term growth potential may mean the difference between having the lifestyle you want, or not having it.

A financial planner can explain this in detail, providing you with peace of mind about your retirement plans.

Investing in high-risk funds can inflation-proof your wealth

Another reason to consider investing in higher-risk funds is to offset the impact of inflation.

Recent data from the Office for National Statistics shows that inflation in Britain reached 2.1% in May 2021, up from 0.7% in March. Yet the Guardian shows the average interest rate for an easy access account was 0.16%, meaning money in savings accounts may lose around 2% of its value in real terms.

Investing your money in funds that expose it to greater potential growth could mean your money outpaces inflation, something that protects your wealth in real terms over the long term.

This could be important if you’re drawing a flexi-access income from your pension.

Keeping some or all of it invested in higher-risk funds can help inflation-proof it, significantly reducing the risk of your retirement fund running out earlier than expected.

Sometimes a lower-risk investment can be more appropriate

If, however, you are looking to buy an annuity with your pension pot, it may be more appropriate to reduce the pension’s exposure to risk as you approach retirement.

As an annuity is a guaranteed income for life, which is purchased using the value of your pension pot. So, reducing the pot’s exposure to a potential downturn just before you retire could be a better strategy.

Another time you should look for lower-risk investments is if you have a shorter time frame in mind. Investments should be made for a minimum of five years, and if you are looking for a period of around this time frame, a lower-risk fund may be more appropriate.

Get in touch

Risk is a complex issue. It’s not only about how you see it, but also about your financial goals, the time you want to invest for, and your current level of wealth.

A financial planner can use sophisticated risk profiling tools and a detailed understanding of your situation to ensure the level of risk your investment is appropriate for you, and why.

If you would like to discuss your investments or pension, the risk within them or your attitude towards it, please email hello@ardentuk.com or call us on 01904 655 330.

Please note

This article is for information only. Please do not act based on anything you might read in this article. Contents are based on our understanding of HMRC legislation, which is subject to change.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The value of your investment (and any income from them) can go down as well as up, which would have an impact on the level of pension benefits available.

Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances. Levels, bases of and reliefs from taxation may change in subsequent Finance Acts.