According to the Guardian, a 91-year-old widow had her energy supply cut off when her bank closed her account after mistakenly believing that she had died. As a result, the widow’s pension and benefit payments were stopped and direct debits from the account were cancelled.

The example highlights how easily mistakes can be made, and that when they do, how they can affect us. What’s more, these effects can be even more severe for vulnerable members of the public, which is one of the reasons why the Financial Conduct Authority (FCA) introduced the Consumer Duty regulation.

The regulation, the main rules of which come into effect at the end of July 2023, aims to increase the quality of service and advice clients receive from financial planners. This, the city watchdog hopes, will provide vulnerable people with greater levels of protection.

If you have clients who are vulnerable, discover how the Consumer Duty could help provide greater levels of protection against financial harm. Before you do, let’s first consider what the FCA’s definition of “vulnerable clients” is.

46% of adult Britons could be classed as vulnerable

Research by the FCA revealed that there were 24 million adults with at least one characteristic of vulnerability in 2020, which represents 46% of UK adults. There are four ways the FCA classes people as vulnerable:

- Health – this includes long-term conditions or short-term illnesses that might affect someone’s physical or mental abilities.

- Life events – bereavement, loss of employment or divorce could result in someone being classed as vulnerable as their situation might affect their abilities to make decisions.

- Resilience – this refers to someone’s ability to withstand financial or emotional shocks. This might be caused by an income that’s inconsistent or a high level of debt.

- Capability – if someone has low levels of confidence when managing their money, or low levels of financial knowledge, they might be classed as vulnerable.

It should also be noted that someone could be vulnerable and stop being so later on. If you have clients who could fall under one or more of these categories and be classed as vulnerable, let’s look at three ways the Consumer Duty could offer greater protection against financial harm.

1. All communication needs to be tailored to your client

Under the Consumer Duty regulations, planners need to demonstrate a deeper understanding of your client’s needs, circumstances and any vulnerabilities they have. Central to this is a need for the financial planner to take the time to understand your client’s vulnerability, and how it might affect their ability to make a good decision.

As a result, all communication with your client must be clear and understandable, and planners must also take their vulnerabilities into account and communicate in an appropriate way. For example, a “one-size-fits-all” letters will need to be replaced with ones that have been tailored to your client to help ensure that a good decision is reached.

Additionally, financial planners must be more proactive in ensuring products and services are provided in a way that allows vulnerable clients to access them. This could include ensuring that access to client portals that contain important information can be accessed easily by vulnerable clients.

2. There needs to be a better understanding of your client’s motivations

Financial planners typically create financial strategies for their clients, which can help ensure goals are reached. To achieve this, the planner must have a clear understanding of the client’s goals and motivations, and then make sure that the strategy dovetails into these.

This enables the planner to provide clearer reasoning for their recommendations, and it’s more likely that your client will be able to understand the reasoning for them.

Under the Consumer Duty regulations, financial planners will need to take time to ensure that they fully understand the motivations and goals of every client, especially vulnerable ones. Doing this could help reduce the chance of incorrect assumptions being made by the planner, which may lead to the wrong product being recommended.

3. The financial planner must be mindful of behavioural biases

Financial planners will need to consider how their communication could trigger a client’s behavioural biases, which may result in poor customer outcomes. As humans we can have many behavioural biases that can affect our decision-making process, based on past experiences, beliefs and the desire to avoid harm.

An example of a behavioural bias is loss aversion, which is where your client makes a decision intended to avoid losses over potential gains. As a result, they may make a decision that inadvertently increases the chance of making a loss in the long term.

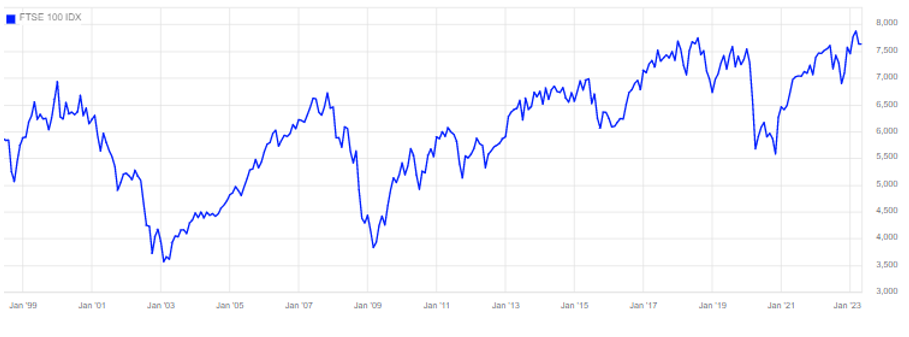

For example, your client may decide to sell their investments when the stock market takes a downturn, which could then turn a paper loss into an actual loss. Worse still, it could deprive your client’s money of the potential to recover when the stock market later bounces back, as it has tended to do historically.

This is backed up by the following example, which shows the performance of the FTSE 100 between March 1998 and March 2023.

Source: London Stock Exchange

Please remember that previous performance is no guarantee of future performance.

Taking the time to better understand your client’s behavioural biases could ensure that the planner communicates with them in a more effective way, which in turn could help your client make better decisions about their wealth.

Get in touch

As an award-winning company that specialises in providing those who are going through a divorce, we are extremely experienced with dealing with clients at a vulnerable time in their life. This is why we support the FCA’s move to provide vulnerable people with better protection from financial harm.

As a company, we have built our success on providing clear, tailor-made recommendations for clients and information that can be accessed and understood by vulnerable clients, as well as those who are financially savvy.

If you would like to discuss how we may be able to help your clients who are vulnerable, please contact us on hello@ardentuk.com or by calling 01904 655 330. As an award-winning financial advice company that was a 2022 VouchedFor Top Rated firm, you can be sure that your clients are in safe hands.

Please note

This blog is for general information only and does not constitute advice. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The information is aimed at retail clients only.

Investments carry risk. The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.