After scammers used the Covid pandemic to steal money, you may have thought they couldn’t sink any lower. If so, think again, as it turns out they are now using the cost of living crisis to try to pinch your cash.

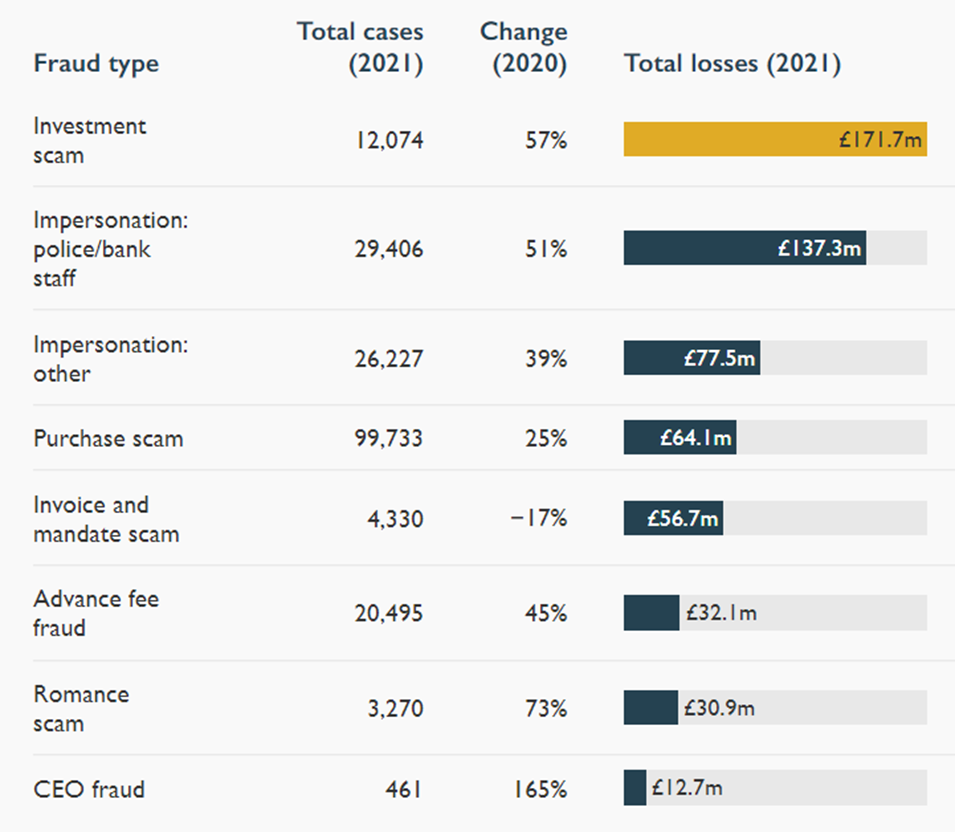

According to Which?, 2022 has seen a surge in bogus energy rebates and phoney competitions. This dovetails into an article by the Times, which revealed that fraudsters stole £583.2 million in 2021, up 39% from the £420.7 million taken in 2020.

So how can you protect your money from criminals? Read on to discover three scams that you need to know about, and tips that could help you spot an investment scam if you’re contacted by criminals.

1. Bogus energy and council tax rebate

As the article by Which? explains, the government announced its Energy Bills Support Scheme that will provide £400 to every household to help deal with skyrocketing gas and electricity prices. This will be shown as a credit on your energy bill in October 2022.

Furthermore, many homes could receive a £150 “cost of living council tax rebate” that will be paid directly to households by their local council.

Yet the consumer watchdog reveals that scammers are contacting people to offer a £150 “energy council tax rebate”, which is an attempt by criminals to steal your cash. They do this by asking for your bank details and then use the information to access your account.

2. Fake bank card refunds

According to Which?, screenshots have started to appear on social media showing money being deposited into someone’s bank account. It also includes messages appealing for people who bank with Barclays to get in touch.

If you have seen this, you will know the screenshot is shared with a message claiming that those who respond could earn up to £15,000. Needless to say, this is a scam.

Fraudsters ask for your bank details and use the information to set up a banking app for your account on their device. This gives them access to your account, which the scammer then uses to dispute a transaction and get a refund.

3. Scam investments

One of the most alarming revelations in the above mentioned Times article is the dramatic rise of investment scams in 2021. According to UK Finance, the body that represents the UK’s banking and finance industry, these types of scams increased 57% when compared to 2020, as shown in the following illustration.

Source: the Times

Sadly, this means that the chances of you being offered a bogus investment could be greater than ever. This may include offers to access your pension savings early, transfer your pension pot or put your money into investments that provide attractive and guaranteed returns.

Always treat these types of “opportunities” with extreme caution as they are likely to be bogus.

Be on your guard against scammers

The soaring number of investment scams is particularly alarming. When you consider that significant amounts of money and your retirement fund could be lost, it’s important to be aware of criminals.

With this in mind, let’s look at five ways you could guard against scammers.

Be diligent on the internet

The internet has many adverts which are promoting bogus investments as criminals try to lure investors into their scams. If you see an advert or comparison website offering higher returns than most, albeit only slightly higher, always be careful. It could be criminals trying to entice you.

Ensure you’re dealing with a bona fide organisation

Fraudsters regularly use company names that are similar to a genuine, regulated business, and will even create “clone” firms that look like authentic companies. One way they will do this is to create official-looking websites and adverts that could include the FCA number, employee names and contact details of the genuine firm.

Furthermore, they provide literature that looks extremely plausible. Always check the Financial Conduct Authority’s (FCA) warning list to see if the company you’re speaking to is on it. If it’s not, check against the FCA register to ensure legitimacy.

Beware of vague explanations

Scammers often use vague explanations of their investments, and attempt to make them sound more genuine by using jargon. They will typically focus on their claims that the investment offers high returns for low risk.

Always remember that greater growth potential means higher risk. Be very wary of any investment that offers high returns for low risk, as it’s probably bogus.

Beware of limited time frames

Research by the Financial Services Compensation Scheme (FSCS) and the Financial Conduct Authority (FCA) suggests that 27% of DIY investors are more likely to invest if an “opportunity” has a limited time frame.

This is particularly alarming when you consider that offering investments with a limited time frame is a trick used by scammers to panic victims into investing. If you are offered an investment opportunity that is only available for a limited period, always think twice.

Work with a bona fide financial planner

Working with a genuine financial planner who is authorised and regulated by the FCA is the best way to protect your money from scammers. A planner will explain what you are investing your money into in a clear and understandable way.

They will also ensure the investment is right for you and explain the growth potential and the risks involved.

Get in touch

If you would like to discuss your investments or how to protect your wealth from scammers, please contact us on hello@ardentuk.com or call 01904 655 330. As an award-winning financial advice company that was a 2022 VouchedFor Top Rated firm, you can be sure that we’re a bona fide company providing excellent advice and high quality service.

Alternatively, watch our informative video that provides plenty of useful information and tips.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.