As the world enters the third year of life with Covid, the financial cost of the pandemic is increasingly being felt.

Aside from the increasing cost of living, which in part is due to Britain’s economic recovery following Covid lockdowns, the UK has seen several tax break freezes come into effect in the 2022/23 tax year.

The freezes were announced in March 2021 by chancellor Rishi Sunak, as he attempted to boost the nation’s finances after supporting the British economy during lockdown. According to the BBC, in the year leading up to March 2021 the government borrowed £303.1 billion – the largest amount since the second world war.

Read on to discover which tax allowances and thresholds have now been frozen, what it could mean for you and how a financial planner could help.

1. Personal Allowance

A key change to the 2022/23 tax year is that the Personal Allowance remains at £12,570 until 2026. This is the amount you are typically allowed to earn before becoming liable to Income Tax. The 40% higher-rate tax threshold remains at £50,270.

According to the Guardian, the freeze could generate an additional £21 billion for the government by 2025/26 as millions of workers see their tax bills rise. If you’re one of them, talking to a financial planner could help ensure that your earnings are as tax-efficient as possible.

2. The Lifetime Allowance

The Lifetime Allowance (LTA) limits the amount of money within your pension pot that receives tax relief. It has been frozen at £1,073,100 until April 2026.

While you’re allowed to have as much money as you like in your retirement fund, if you access any amount that’s above the LTA, you could be liable to a tax charge of up to 55%.

Following the allowance freeze, a larger proportion of your pension may be liable to the charge, as the investments contained within it may grow in value while the LTA remains static.

There is good news though. As the charges are only payable on cash that’s withdrawn above the LTA, you might not need to worry. A financial planner can confirm this and may provide more tax-efficient options if you face a charge.

3. Capital Gains Tax annual exemption

If you sell an asset in the 2022/23 tax year, the annual exemption means you can typically make a profit of £12,300 before Capital Gains Tax (CGT) is due. As the exemption has been frozen until April 2026, your assets might face a greater CGT liability.

This is because they may increase in value while the exemption remains the same. Depending on the asset being sold and your marginal tax rate, CGT could be charged at between 10% and 28%. Certain assets, such as your home, are not liable to the tax.

There are ways of reducing your exposure to CGT, which a financial planner can help with. For example, you may be able to use the end and beginning of the tax years, or split the ownership of assets with your spouse or civil partner.

4. Inheritance Tax nil-rate band

Another allowance that’s been frozen for the next four years is the Inheritance Tax (IHT) nil-rate band. It remains at £325,000 and the residence nil-rate band stays at £175,000.

This means you may be able to leave up to £1 million to loved ones before your estate becomes liable to IHT, which is typically charged at 40%.

The freeze may expose your estate to a greater IHT liability as your assets could increase in value while the thresholds are static. That said, there is good news, as the government typically allows you to make gifts that could help reduce or negate any IHT liability.

There are also investments available that may allow you to pass money to loved ones IHT-free. That said, IHT planning is complex and can carry risk, so always speak to a financial planner to ensure any action you take is right for you.

The 2022/23 tax year has seen tax increases too

In September 2021, the prime minister announced National Insurance contributions (NICs) and Dividend Tax rates would increase by 1.25 percentage points in 2022/23.

The increase aims to deal with the growing health and social care crisis in Britain, and has seen the government pledge £39 billion over the next three years to deal with it.

So, let’s consider these increases now.

Dividend Tax

While the amount of tax you pay on dividends will typically increase, the good news is that the Dividend Allowance remains at £2,000. This means, you could generate an average dividend income of 4% from a £50,000 investment without being liable to the tax.

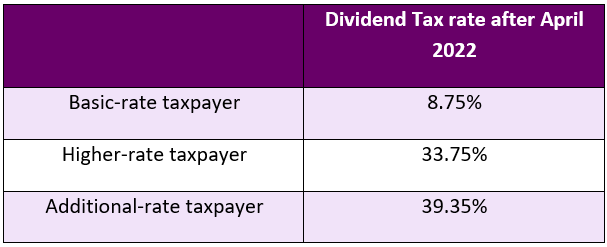

The table below reveals the new Dividend Tax rate for basic-, higher- and additional-rate taxpayers.

National Insurance contributions

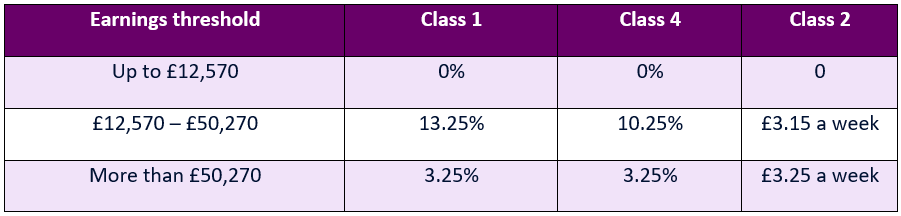

While NICs increased from 6 April, the chancellor has also increased their threshold. As from 6 July, it increases to £12,570, after which NICs will be charged at the following rates:

Between April 6 to July 5, if you earn between £9,881 and £50,270 as an employed person you will be liable to Class 1 NICs at 13.5%. If you’re self-employed, you will need to pay Class 4 NICs at 10.25%, and Class 2 NICs at £3.15 a week.

According to the BBC, if you earn more than £34,000 a year it’s likely your NICs liability will rise. If this includes you, speaking to a financial planner to potentially reduce your liability might be a shrewd move.

Get in touch

If you would like to discuss ways you could ensure your finances are as tax-efficient as possible, please contact us on hello@ardentuk.com or call 01904 655 330.

As an award-winning financial practice, named as a 2022 VouchedFor Top Rated firm, you can be sure of the very best advice and an excellent service.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.