The start of the new year is an ideal time to plan ahead, especially when it comes to your finances. It’s a good time to assess financial strategies, tax efficiency, and how best to protect wealth from inflation, which rose significantly in 2021.

Planning ahead is fundamental to good financial practice, and should include five tasks that can help maintain the growth potential of investments, ensure pensions are on track, and maximise tax efficiency.

Read on to discover what these tasks are, and why they could help your clients going into 2022 and beyond.

1. Rebalance investments

Investments typically comprise of different funds and assets, including stocks and shares, government bonds or cash. Over time these funds and assets increase or decrease in value, which could reduce their growth potential or expose them to unnecessarily high levels of risk.

For example, strong stock market returns might mean that a client suddenly has a greater proportion of their wealth in equities.

Rebalancing investments can realign them to where they should have been originally. This could improve growth potential when the market rises and better protect against a fall in value if the market drops.

2. Start or assess existing pensions

If your client doesn’t have a pension in place, they should probably consider one. The sooner they start contributing, the more they could have in retirement. More than this, the government contributes towards pensions through tax relief, giving retirement plans a significant uplift.

Because of this, every £100 your client contributes will typically cost them £80 if they’re a basic-rate taxpayer, and £60 if they’re a higher-rate taxpayer. If they’re an additional-rate taxpayer, they will pay £55 for every £100 contributed.

This is subject to the Annual Allowance, which limits the amount of contributions your client can make and receive tax relief on. In 2021/22, the limit is £40,000 or the amount they earn – whichever is the lower.

If your client already has a pension, they should assess its performance and whether it will provide the income needed in retirement. If it’s not on track, a financial planner could help them understand their options, which may include rebalancing the funds, altering the level of risk the pension’s exposed to, or merging separate pensions into one.

3. Inflation-proof wealth

According to the latest figures from the Office for National Statistics, inflation reached 5.1% in November 2021, the highest level for more than a decade. As inflation is the rising cost of goods and services, it has the potential to reduce your client’s wealth in real terms, as £100 in the future will likely be worth less than it is today.

As investments may provide greater growth potential, your clients may want to consider investing to inflation-proof their wealth – especially when you consider interest rates are currently at historic lows.

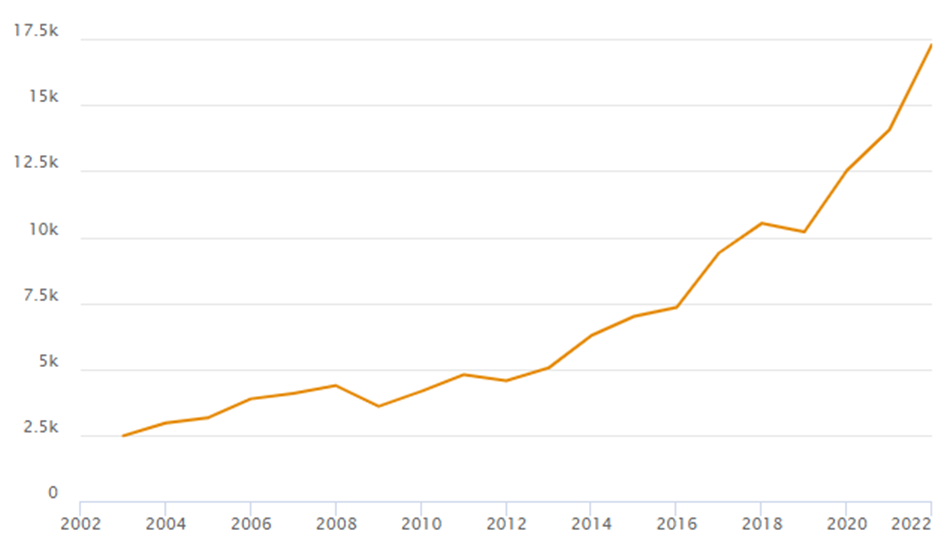

To demonstrate this, consider the following graph. It shows the performance of the MSCI index from January 2002 to January 2022. The index tracks the stocks and shares of companies in 23 developed nations and, as you can see from the value on the left-hand axis, it has increased significantly despite downturns along the way.

Source: MSCI

Always remember that past performance is no guarantee of future performance, and your client should not enter into investing lightly. They should always speak to a financial planner to ensure it’s right for them.

4. Start or review an Inheritance Tax strategy

As Inheritance Tax (IHT) is typically charged at 40%, it can significantly reduce the amount your clients leave to loved ones. Worse still, in March 2021 the chancellor froze the amount they can have in their estate before IHT is due.

Known as the nil-rate band (NRB), it typically allows a single person to have £325,000 before the tax is due, and married couples to have £650,000. If your client is eligible for the residence nil-rate band (RNRB), these amounts could increase to £500,000 or £1 million, respectively.

As both have been frozen until 2026, clients may face a higher IHT liability as the value of their investments and property could continue to increase while the threshold remains the same.

Creating an IHT strategy and reviewing it regularly could help your clients reduce or potentially negate an IHT liability through several gifts the government allows you to make every year.

Another way they could reduce their exposure to the tax is to use a potentially exempt transfer (PET). This allows them to make unlimited gifts to whoever they like, although they must then live for seven years for it to no longer be liable to IHT.

If they do not, the estate could be charged IHT at a rate that’s based on a sliding scale and on any other gifts they’ve made. As you can see, this means the earlier your client starts implementing an IHT strategy, the better.

5. Consider any lump sums received

In particular, if your client has received a lump sum, such as an inheritance, they might want to consider how best to use it. For example, they may want to boost their pension or put it in a tax-efficient ISA.

As ISAs are not liable to Income Tax or Capital Gains Tax on any growth, this could mean your client can take an income completely tax-free. If they invest in a Stocks and Shares ISA, they may also be able to inflation-proof their money.

Get in touch

With complicated rules and regulations around IHT and pensions, it’s important to speak with a financial planner who can ensure your client doesn’t fall foul of taxes or other regulations.

If you feel these five tasks could benefit them, and would like to discuss things further, please contact us at hello@ardentuk.com or call 01904 655 330. As award-winning specialists in financial planning, you’ll have peace of mind that we will work in a way that helps your clients and enhances your reputation.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances, tax legislation and regulation, which are subject to change in the future.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.