Research featured in Professional Adviser makes a startling revelation. It shows that while 34% of Britons over the age of 55 have spoken to a financial planner, many are not using advisers to help prepare financially for retirement.

Furthermore, the reason for this was cost. If your client is one of those who believes that speaking to a financial professional does not represent value for money, they may need to take care, as not doing so could cost them dearly in the long term.

This is because your client’s pensions and wider wealth may not be exposed to the same levels of growth potential as they would if they worked with a financial planner. As a result, your client’s pension pot may be significantly lower when they come to retire, which means the decision not to work with a planner could be the more expensive option.

Furthermore, not speaking to a financial planner might mean that your client is inadvertently exposed to more tax than they need to be, which might mean they’re worse off financially over time. Read on to discover five important ways speaking to a financial planner could represent value for money by helping your client become more savvy with their retirement fund and wider wealth.

1. Financial benefits

Perhaps the most obvious benefit of financial planning is that it can benefit clients financially in the long term.

According to Royal London’s Feeling the Benefit of Financial Advice report, working with a professional adviser or planner could lead to an increase in wealth. It reveals that those who took financial advice were on average £47,000 better off, with those who had an ongoing working relationship with an adviser being up to 50% better off than those who took advice once.

As you can see, this could help your clients improve their standard of living, achieve their goals in life or secure their lifestyle when they retire. Furthermore, boosting their pension fund could help your clients to retire earlier than they intended, and still enjoy the retirement they dream of.

A financial planner could also help ensure that your client’s wealth is as tax-efficient as possible. This might, for example, allow them to reduce their exposure to Inheritance Tax and leave more money to loved ones, or reduce their exposure to Income Tax when they draw an income from their pension.

2. High quality financial coaching

Having a financial planner who provides coaching could help your client better understand their financial situation and investments. This could help them sidestep a decision they later regret, such as selling investments during a stock market downturn, which could turn a paper loss into an actual one.

If your client is approaching retirement, a financial planner could help them budget for retirement, so avoid inadvertently depleting their pension earlier than expected after taking too much income. This means your client can rest easy in the knowledge that they can enjoy the lifestyle they want, while remaining financially secure.

3. Improved emotional wellbeing

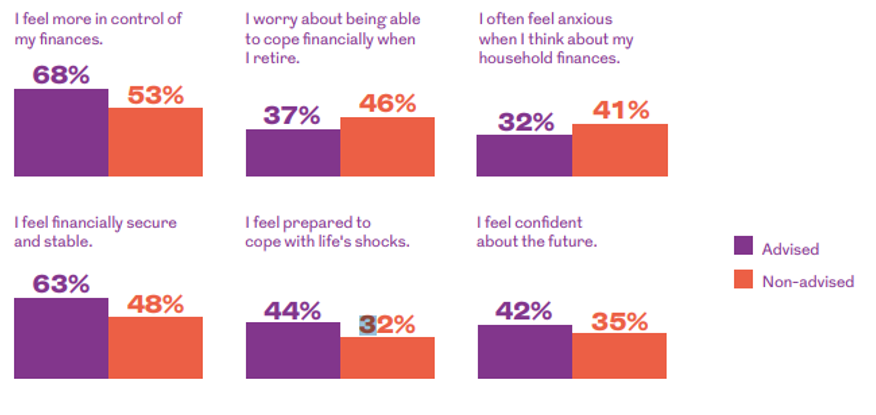

The Royal London study above also highlighted the emotional benefits of working with a financial planner. According to the study, working with a planner could provide your clients with the confidence to make better decisions with their wealth and pension pot, which could bring financial peace of mind both now and in retirement.

To demonstrate this you might want to consider the following illustration, which was taken from the Royal London study. It reveals that 68% of those who worked with a financial planner said they felt more in control of their finances, with 63% saying they felt more financially secure and stable.

4. Help keep your client’s wealth on track

Forming a long-term working relationship with a financial planner means that they can monitor the performance of your client’s investments or pensions. As such, a planner can confirm whether your client’s investments or pensions are on course to meet their aspirations, which could be particularly important if they’re approaching retirement.

Furthermore, a planner will provide your client with options if their investments or pensions are not performing as well as hoped. This could provide reassurance for your client that they can get their wealth back on track to where it needs to be to provide the lifestyle, and retirement, they want.

5. Help your client to consider the “what ifs”

While it’s impossible for your client to predict the future, a financial planner could help your clients plan for their future based on possible outcomes and not a hunch. By using sophisticated software called “cashflow modelling”, a planner can visualise the potential outcome of any decision your client makes, both now and in the future.

As cashflow modelling takes into account your clients income, outgoings, assets and liabilities, as well as factors such as market performance and inflation, it allows your client to explore several “what ifs”.

This provides your clients with an understanding of the likely outcome of their decisions. While the outcome can never be guaranteed, cashflow modelling can help provide some assurance that the outcome may help your client achieve their goals or remain financially secure.

Get in touch

As you can see, there are several reasons why working with a financial planner provides excellent value for money. This might be by helping to expose your client’s wealth to greater growth potential, or allowing them to enjoy a better standard of living thanks to the peace of mind provided.

That said, care should always be taken to ensure that your client is working with a financial planner who provides value for money, and a first-class service. As an award-winning financial advice company that was a 2022 VouchedFor Top Rated firm, you can be sure that your clients will receive excellent advice, high-quality service and value for money.

If you would like to discuss this further, please contact hello@ardentuk.com or call 01904 655 330.

Please note

This blog is for general information only and does not constitute advice. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances, tax legislation and regulation, which are subject to change in the future.

Investments carry risk. The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.