If you’re a woman in her mid-30s, research suggests you could soon start to see your pension pot shrink more significantly in comparison to male counterparts. That’s according to a study by Aviva, which found that the gap between male and female pension contributions starts to widen from the age of 35.

The pension provider revealed that, between the age of 35 and 39, contributions are 18% lower for women, something that then rises to 29% by the time they’re aged 45 to 49 years old.

Between 65 and 69 years, the gap in contributions widens to nearly half (49%). The study’s findings, which were based on just over 2 million savers and retirees, suggests that women’s financial security could be at risk later in life.

Read on to find out why the gap between contributions often widens at 35, and clever steps you could take to help ensure your retirement fund provides you with the lifestyle you want.

The gender pay gap typically affects mothers

According to Aviva, the gap widens at the age women decide to swap their career for childcare, and opt to work part-time. This is because their income and pension contributions typically drop significantly, which also reduces their retirement fund’s growth potential.

According to the pension provider, if you decide to reduce your hours to three days a week because of childcare, you could expect your pay to reduce by 40%. The problem is that under auto-enrolment rules, your workplace pension contributions could reduce by more than 50% of their full-time value.

Indeed, Aviva calculates that if you earn £20,000 working part-time, you could see your pension contributions reduce by more than 58%. That said, there are five clever steps you could take to counter the effects of your reduced contributions, which we will consider now.

1. Boost your pension contributions

As pension contributions typically receive tax relief, as a basic-rate taxpayer you’ll pay just £80 for every £100 contributed towards your pension (2022/23). If you’re a higher-rate or additional-rate taxpayer, you’ll pay £60 or £55 respectively.

With this in mind, increasing contributions as much as possible could offer a significant boost to your pension pot, which could provide a higher income when you retire. This could provide the lifestyle you would like in retirement, whatever the future holds.

Please remember, pension contributions are limited by your Annual Allowance, which in 2022/23 is the lower of £40,000 or the amount you earn.

2. Use “carry forward”

If you have a lump sum, such as an inheritance, you may want to consider using carry forward to boost your pension pot. This allows you to use unspent allowance from the previous three years, which means you may be able to contribute up to £160,000 in 2022/23 and still receive tax relief.

3. Contribute more to your workplace scheme

If your employer matches your pension contributions, increasing them to as much as you can afford could be a very shrewd move. With matched contributions you’re effectively doubling your money, which could boost your retirement pot significantly and provide a better standard of living in retirement.

4. Find lost pensions

If you’ve lost a pension, finding it could also help increase your retirement fund. According to Unbiased, UK workers have lost up to 1.6 million pensions with an estimated value of £19.4 billion.

If yours is one of them, a financial planner could help you find it and then help you understand how to use it to potentially increase your retirement fund. For example, you might want to consider merging it with other pensions to boost potential growth.

5. Invest any savings you have

If you have contributed as much as you can into pensions and still have cash savings, you may want to consider investing the money. This is because it could help “inflation-proof” your cash.

As inflation is the rising cost of living, £1 in the future is likely to buy less than it would today. As a result, if you have cash savings that are not keeping pace with inflation, the money could be worth significantly less in real terms by the time you retire.

According to the latest figures from the Office for National Statistics, inflation stood at 7% in March 2022, up from 6.2% the month before. Yet Moneyfacts reveals the top easy access savings account pays just 1%, with the best fixed-rate account – which involves locking your cash away for up to five years – paying 2.4%.

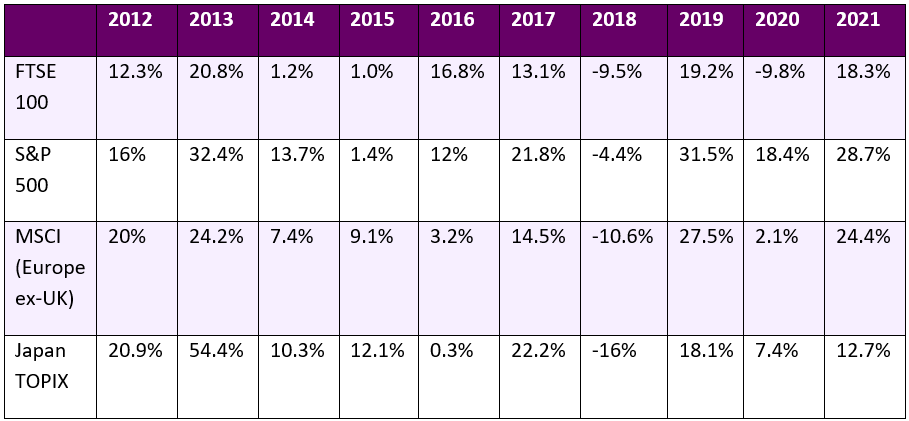

As you can see, both of these are significantly below inflation. Compare this to the table below, which shows the annual returns of some of the major stock indices over the 10 years leading up to 2021.

Source: J.P. Morgan, FTSE, MSCI, Refinitiv Datastream, Standard & Poor’s, TOPIX, J.P. Morgan Asset Management. All indices are total returns in local currency, except for MSCI Asia ex-Japan and MSCI EM, which are in US dollars. Past performance is not a reliable indicator of current and future results. Data correct as of 31 January 2022.

As you can see, with one or two exceptions, the stock markets have largely produced annual returns that could help inflation-proof your money over the long term. Always remember, past performance is no guarantee of future performance, and you may receive less than your initial investment.

Get in touch

If you would like to discuss ways you could boost your pension or secure your financial future in retirement, please contact us on hello@ardentuk.com or call 01904 655 330.

As an award-winning financial practice, named as a 2022 VouchedFor Top Rated firm, you can be sure you will receive the very best advice and an excellent service.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances, tax legislation and regulation, which are subject to change in the future.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.