Every time you switch on the news or open a paper in 2023, it’s likely that you’ll find a story about inflation. There are constant warnings about high inflation and the far-reaching impact on the price of goods and services, as well as your savings.

The good news is, once you understand the relationship between savings interest rates and inflation, you can make informed decisions to potentially help your money maintain its value in real terms.

However, a new study from Aviva found that only 44% of people understood how inflation was affecting their savings.

Read on to learn more about why inflation could be bad for your cash savings, and what you can potentially do about it.

Compound interest drives savings growth

The Aviva study shows that only 37% of people know how compound interest works and, without an understanding of how your savings grow, it is difficult to see what the effects of inflation could be. That’s why it is important to first consider what compound interest is and how it benefits you.

In simple terms, compound interest is calculated based on the principal amount, as well as the interest accumulated from previous periods. For example, if you put £1,000 into a savings account with a 1.5% interest rate, you would have £1,015 the following year.

The next year, you gain another 1.5% on the additional £15 interest, as well as the principal amount of £1,000, meaning that you net more total interest, even if the rate remains the same.

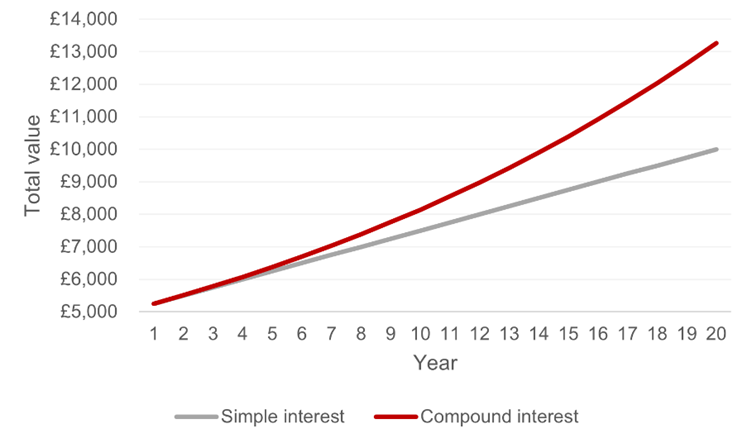

This additional growth on the previous year’s interest quickly builds over time. Indeed, according to AJ Bell, if you invested £5,000 with average growth of 5% a year, you would have £8,235.05 after 10 years due to compound interest.

However, if you only received interest on the original £5,000, your total would be £7,500. So, compound interest could create significantly higher returns on savings and investments.

Source: AJ Bell

As you can see, provided you don’t make withdrawals from the savings account, the compound interest can create a “snowball effect”.

However, when the rate of inflation is higher than your savings account interest rate, it may negate the benefits of compound interest. In some cases, this could mean that your savings lose value in real terms.

Inflation reached 10.1% in the 12 months to March 2023

The inflation figures quoted on the news are usually based on the Consumer Prices Index (CPI). It compares the prices of around 750 different goods and services with prices 12 months previously to give an indication of how costs have changed.

According to the Office for National Statistics (ONS), this inflation figure reached 10.1% in the 12 months to March 2023. Let’s consider how your savings growth compares with this.

If you put £1,000 into a savings account with an interest rate of 3.71% – the best easy access rate as of May 2023 according to Moneyfacts – and left it for a year, you would have £1,037.10.

But the same goods and services that cost you £1,000 would now cost £1,101 a year later due to inflation of 10.1%. That means the purchasing power of your savings has actually decreased, even though you are generating interest on them.

As such, when the rate of inflation is higher than the interest rate on your savings account, your wealth is likely losing value or remaining static. Fortunately, there are ways you can potentially prevent this if you reconsider how much of your wealth you hold as cash savings.

Investments may help you combat inflation

Cash savings can act as a useful buffer against financial shocks, and it may be a good idea to keep an emergency fund in an easy access account to protect yourself. However, if you’re saving for a period of five years or longer, investing a portion of your wealth could encourage more growth and help you combat the effects of compound inflation.

That’s because the long-term returns on investments in the stock market could outpace the rate of inflation. For example, figures from Investopedia show that, between 1957 and 2021, the S&P 500 showed an average annual return of 8.5%, when adjusted for inflation. Returns in specific years may also be much higher – in 2013 there was growth of 32.15%, for example.

This means that your investments in the stock market would likely have grown, even when taking the impact of inflation into account, and you may have seen higher returns than if you held your wealth as cash savings.

But it is important to remember that in certain years, returns may be lower and you could see losses.

This is the key difference between investments and cash savings, and perhaps the reason why some people are more inclined to keep large amounts of cash. There is always an element of risk with investing, and you likely need to consider your own attitude to risk and your medium- to long-term financial goals when making decisions.

However, taking too little risk with your wealth could see the value of your wealth reduce in real terms. You may not generate the growth you need to meet your long-term goals.

You may also want to take some advice to ensure that you are managing risk effectively and your investment strategy aligns with your wider goals.

Get in touch

If you want to explore ways to potentially protect your wealth from rising inflation, we can advise you on the different investment options available to you.

Please contact us on hello@ardentuk.com or call 01904 655 330. As an award-winning financial advice company that was a 2022 VouchedFor Top Rated firm, you can be sure that we’re a bona fide company providing excellent advice and high-quality service.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.