Making regular contributions to your investments may help you build wealth over time. If you see capital growth and income from dividends, you might decide to take those returns and use them to fund your lifestyle or work towards other financial goals.

However, if you reinvested your returns instead, you could benefit from compounding.

Compounding is a powerful concept in investing that involves generating growth on your original investment as well as your previous returns. Leveraging the power of compound returns could help you achieve more growth over time.

Eventually, if you take a long-term approach, you could reach the “compound investment tipping point”.

This is the point at which your returns exceed your total initial investment.

Read on to learn how compound returns work and how you could reach the compound investment tipping point.

Compound returns could help you build wealth faster

The power of compounding could mean that the value of your investments grows faster than they would if you withdrew your returns.

For example, according to Barclays, if you invested £10,000 and saw returns of 2% in the first year, you would have £10,200.

The following year, you generate 2% growth on your £10,000 as well as the additional £200 you earned in the first year. This means you would have £10,404.

Yet, if you withdrew the 2% income so you were only generating growth on your initial investment, you’d have £10,400.

While this doesn’t seem like a big difference, the effects of compounding build over time and can drastically increase the value of your investments in the long term.

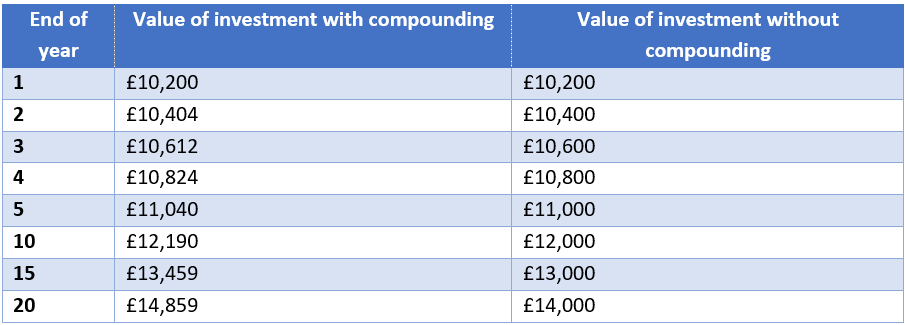

The following table shows the difference that compound returns can make to the value of your investments. It assumes a £10,000 initial investment with annual growth of 2%.

Source: Barclays

As you can see, compounding could have a powerful effect on your ability to build wealth over time.

It’s also worth noting these figures are based on a single investment of £10,000. You may invest more than this if you make regular contributions and the growth you see could exceed 2% in certain years.

As such, the effects of compounding may be much greater, and you could reach the compound investment tipping point.

The compound investment tipping point demonstrates the benefits of a long-term approach

Compound returns can create a snowball effect and there may come a point when your returns exceed your initial investment.

Figures from interactive investor demonstrate how this works. They report that if you invested £250 each month with a 5% annual return, you would contribute £3,000 in one year, and see £83 growth.

After the first year, your returns equal just under 3% of the value of your contributions. The effect of compounding means the figure rises to around 5% in year two and almost 14% by year five.

By year 26, your monthly contributions would total £78,000 and the total value of your investment would be £160,299. This means that your returns now equal 105% of the value of your contributions.

As such, you would have reached the compound investment tipping point.

This demonstrates how compound returns could help you achieve significant growth over the long term, despite any short-term market fluctuations.

Conversely, if you panic and cash out investments during a period of market volatility, you may not be able to reach the compound investment tipping point.

4 ways to increase your chances of reaching the compound investment tipping point

- Understand your attitude to risk

You always adopt some level of risk when investing and finding the right balance is crucial.

If you take on too much risk, you may experience significant losses. On the other hand, if you are too cautious, you may struggle to achieve the growth you need to reach the tipping point.

As such, it’s important to understand your attitude to risk and find investments that you feel comfortable with, while also considering the growth you are likely to achieve.

- Check your fees

Many investment products have associated fees to cover transaction or management costs. Prices vary but if many of your investments have high fees, this could affect your returns.

While there are numerous factors to consider when choosing an investment product, you may want to check how much you are paying in fees. If you can make adjustments and choose more low-cost investment products, you could maximise your returns and potentially reach the compound investment tipping point faster.

- Drip-feed your investments

Drip-feeding funds into the market each month – known as “pound cost averaging” – could help you smooth out market fluctuations. This is because you buy some shares when prices are high, and some when prices are low, potentially averaging out the cost.

This could help you maintain your returns and make steady progress towards the compound investment tipping point.

- Diversify your investments

Diversifying your investments may protect you against market volatility as the poor performance of one stock doesn’t harm the overall growth of your portfolio.

As such, you may want to spread your investments across different product types, industries, and geographical areas. This could reduce the chances of any significant losses and help you maintain steady, long-term growth.

Get in touch

We can help you take a long-term approach to investing and potentially reach the compound investment tipping point.

Please contact us at hello@ardentuk.com or call 01904 655 330. As an award-winning financial advice company that was a 2022 VouchedFor Top Rated firm, you can be sure that we’re a bona fide company providing excellent advice and high-quality service.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.