On 5 August, global stock markets fell sharply after fears of a US recession caused a mass sell-off among investors.

According to the Guardian, the S&P 500 fell by 3% – its biggest daily loss since September 2022 – and the Dow Jones Industrial Average fell by 2.6%. The Nasdaq finished the day down 3.4%.

Japanese markets also experienced volatility as the Nikkei 225 – an index of the Tokyo stock market – dropped by 12.4%, which was its worst day since Black Monday in 1987. The British markets followed suit as the FTSE 100 recorded its biggest one-day decline in more than a year.

As an investor, it’s natural to be concerned when you hear news of a stock market fall of this kind. However, it’s important to note that volatility is relatively common and there have been countless periods of volatility throughout history. This includes:

- The Wall Street Crash in 1929

- Black Monday in 1987

- The dot-com bubble in the late 1990s

- The 2008 financial crisis.

Despite these fluctuations, markets typically recover and continue growing in the long term. Unfortunately, you may still panic if you see the value of your portfolio fall, and this might lead to poor decision-making.

Read on to learn the top three mistakes that investors make during a volatile market.

1. Panic selling

You may worry when you see the value of your portfolio fall because you’re likely investing to build wealth and achieve your dream lifestyle. Consequently, a period of volatility could make you feel as though it will be harder to reach important life goals. In turn, you might be tempted to sell investments before the markets fall any further so you can limit your losses.

However, panic selling turns a theoretical loss into an actual one, and you could miss out on growth in the future if and when markets bounce back. Indeed, while past performance is not necessarily indicative of future performance, historical data shows that it may be likely for the stock market to recover.

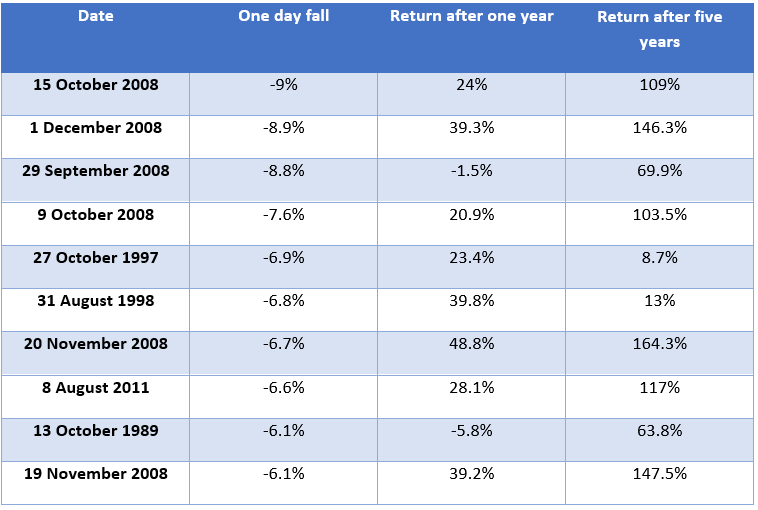

The following table shows 10 of the largest daily falls in the US stock market, and the subsequent returns after markets recovered. Figures are based on the total returns from the S&P 500.

Source: Schroders

If you were invested in the US stock market on 15 October 2008, you may have panicked and sold your investments when the S&P 500 fell. This would’ve meant you “locked in” losses of 9%.

Conversely, if you remained calm and held your investments for another year, you would’ve seen growth of 24% after the markets bounced back. After five years, you would’ve benefited from returns of 109%.

This means that avoiding the impulse to panic sell may have meant that you were better able to work towards your long-term goals than you would’ve been if you had cashed out your investments.

As the table demonstrates, this was often true during periods of volatility.

While past performance doesn’t guarantee future returns, the historical data suggests that panic selling during a period of volatility could be a mistake.

2. Holding too much wealth in cash savings

Regular periods of volatility might worry you and lead you to believe that cash is a “safer” option. After all, if you hold your wealth in cash savings, you may generate interest on it and you won’t be affected by market fluctuations outside of your control.

However, if you hold too much of your wealth in cash, you may find it more difficult to achieve the level of growth you need to meet your long-term goals.

For instance, according to MoneySavingExpert, the highest interest rate on an easy access Cash ISA on 9 September 2024 was 5%.

In comparison, Curvo reports that the average compound annual return from the FTSE All-World – an international index of stocks from developed and emerging markets – was 10.12% between September 2003 and June 2024.

Consequently, while it may be beneficial to hold some cash as an emergency fund, investing could offer higher returns in the long term.

Also, bear in mind that cash savings interest rates have risen considerably in recent years. However, the Bank of England (BoE) reduced its base rate – the interest rate it charges to other institutions – from 5.25% to 5% on 1 August 2024.

As a result, banks and building societies may reduce their cash savings interest rates soon and this could make it even more difficult to grow your wealth if you hold too much cash.

Yet, if you invest and resist the temptation to rely too heavily on cash during periods of market volatility, you may find it easier to reach your financial goals.

3. Trying to “time the market”

Another common mistake that investors make is trying to take advantage of fluctuations and “time the market”.

For instance, when markets are falling, you might try to predict when they will reach their bottom, so you can invest and benefit from significant growth when they bounce back.

Alternatively, if the value of your portfolio increases, you might aim to sell when markets reach their peak, so you can realise your gains.

Unfortunately, markets are unpredictable and the value of your portfolio could be affected by many different economic, political, and social factors. For instance, you likely wouldn’t have been able to predict events such as the Covid-19 pandemic or the war in Ukraine.

If you make mistakes when trying to time the market, you could experience significant losses that disrupt your financial plan.

Instead, it may be more beneficial to stick to your current investment strategy and take a long-term approach.

It’s important that you avoid these three common investing mistakes during periods of volatility, so you can continue working towards your goals.

Get in touch

We can help you develop an investment strategy that aligns with your priorities in life and offer reassurance when the value of your portfolio falls temporarily.

Please contact us at hello@ardentukstg.wpenginepowered.com or call or WhatsApp us on 01904 655 330. As an award-winning financial advice company with advisers included in the 2024 VouchedFor Top Rated guide, you can be sure that we’re a bona fide company providing excellent advice and high-quality service.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.