Financial literacy means having the knowledge and skills to make decisions about your wealth.

People with high levels of financial literacy may find it easier to make informed decisions and build a robust financial plan. Those who are less financially literate, on the other hand, may find it difficult to plan for the future or deal with financial challenges.

Unfortunately, many of us grow up without developing these skills. Indeed, FTAdviser reports that only 47% of children receive meaningful financial education at home or school.

These gaps in our education often transfer to adulthood, and studies show that there is a distinct lack of financial knowledge in the UK.

Read on to learn what the latest data on financial literacy says, and how a financial planner could help your clients fill gaps in their knowledge.

Three-quarters of Brits fall below the financial literacy benchmark

A new study reported by FTAdviser sought to establish the level of financial knowledge among people in the UK, and how this affected their financial lives.

Under the parameters of the study, participants needed to score at least 6.5 out of 10 to be considered “financially literate”.

The study found that 73% of people fell below this benchmark, making Brits less knowledgeable than those in countries with similar economies like France, Canada, and New Zealand.

Surprisingly, only 5% of people answered all the questions correctly and the average respondent only answered half right.

Additionally, the study found that young people are more likely to have gaps in their knowledge. That said, people of all ages fell below the benchmark for financial literacy.

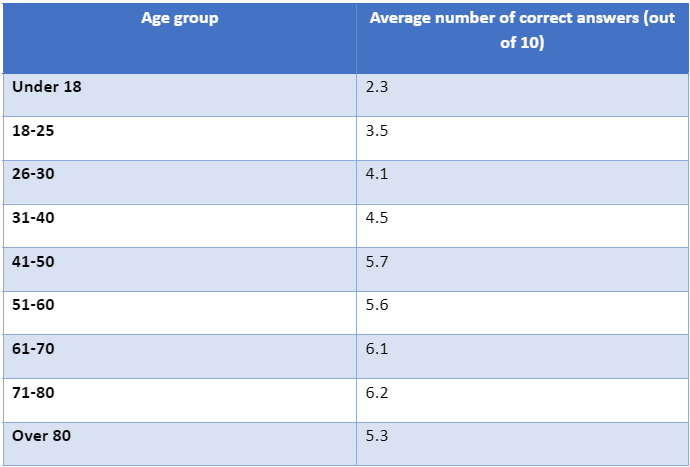

The following table shows the average scores of each age group:

The results of this study suggest that, while life experience might help your clients develop some level of financial literacy as they get older, they may still have significant gaps in their knowledge.

Consequently, their financial health could suffer and they may be less prepared for the future.

A high level of financial literacy leads to positive habits

The study not only considered how financially literate people were, but it also looked at how this affected their behaviour.

It found that people with more in-depth financial knowledge tend to have more positive habits around their wealth.

For example, 71% of people in the top quartile contributed to a pension pot, compared with just 40% of those in the bottom quartile.

Additionally, 13% of the top scorers put money into savings while only 8% of the bottom scorers did.

As such, improving financial literacy is one of the best things that your clients can do to improve their financial health and build wealth for the future.

How a financial planner can help your clients improve their financial literacy

Working with a financial planner can help your clients develop their financial literacy in several ways.

Translating complex financial terms

Many financial concepts are difficult for clients to grasp because there are a lot of complicated terms involved. A financial planner can translate this financial jargon into simple terms that your clients can easily digest.

This may help them understand what tax they are likely to pay on investment returns or how different investment options work, for example. Often, your clients may be apprehensive about investing their wealth for the future because they don’t fully understand how investments work.

Fortunately, having a financial planner explain these topics may allow your clients to explore new opportunities to grow their wealth and secure their financial future.

Demonstrating the value of good financial habits

Learning how certain decisions and habits affect their wealth in the future can help clients improve their understanding. A financial planner can use cashflow planning to demonstrate this.

They will input all your clients’ information into sophisticated software that generates a visual interpretation of their financial plan, with projections of their future situation. This is a powerful tool for showing clients exactly how changes that they make now could benefit them in the future.

For example, it is easier to recognise why saving for retirement is important and how much they should save if they can see how their pension contributions build over the years.

Once they can see precisely why they are doing something and what the eventual outcome is, it may be far easier for your clients to understand.

Learning from challenges

Most people will likely face challenges with their finances at some stage of their life. The current cost of living crisis, for example, may put pressure on your clients and they may need to adjust their financial plan to ensure they are still able to meet their long-term goals.

A financial planner can support your clients during difficult periods like this and help them learn from them. As a result, they will be more knowledgeable and better prepared to deal with challenges in the future.

Get in touch

Everybody can benefit from a better understanding of their finances. If your clients are concerned about their own financial literacy, please encourage them to get in touch.

They can contact us at hello@ardentuk.com or call 01904 655 330. As an award-winning financial advice company that was a 2022 VouchedFor Top Rated firm, you can be sure that we’re a bona fide company providing excellent advice and high-quality service.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

The Financial Conduct Authority does not regulate cashflow planning.