Living a healthy lifestyle is becoming increasingly important for many of us, as we learn more about the positive benefits of staying active and eating well.

Indeed, according to Sport England, between November 2021 and November 2022, 63.1% of UK adults engaged in 150 minutes or more of moderate physical activity a week. This was an increase of 1.7% on the previous year. Additionally, the number of people classed as “inactive” fell by 1.4% in the same period.

These figures suggest that many adults are taking steps to improve their physical health and potentially increase their lifespan, and you might be doing the same.

However, you could face issues in later life if you don’t give the same attention to your long-term financial plan, and research shows that this is a problem for a large proportion of UK adults.

Read on to learn more.

The UK population is 5 times more likely to focus on physical longevity than long-term financial stability

If you plan to improve your health and potentially live for longer, it may be useful to consider how you will fund your lifestyle for those extra years. Unfortunately, new figures show that many UK adults don’t prioritise financial longevity.

In fact, Money Marketing reports that, in a recent survey, 51% of respondents said they prioritised their physical longevity. In comparison, only 9% said their financial longevity was a key focus for them.

When asked about measures they took to improve their health:

- 44% of people aimed to reach 10,000 steps a day

- 30% invested in premium dietary supplements on a weekly basis

- 16% consumed a specialist diet.

However, when asked about steps to increase their long-term financial stability:

- Only 16% reported using financial apps on a weekly basis to help with budgeting

- 20% didn’t know how much of their income they contribute to their pensions

- 61% hadn’t consulted a financial adviser.

These figures clearly demonstrate that many people focus more on their health than their finances. In fact, UK adults are more than twice as likely to track their daily steps as they are to monitor pensions and investments.

While investing in your health is crucial, it could lead to significant financial planning challenges if you’re unable to fund a longer life.

Life expectancies are likely to continue rising over time

As medical technology improves and the general public take more interest in their health, UK life expectancy has increased significantly.

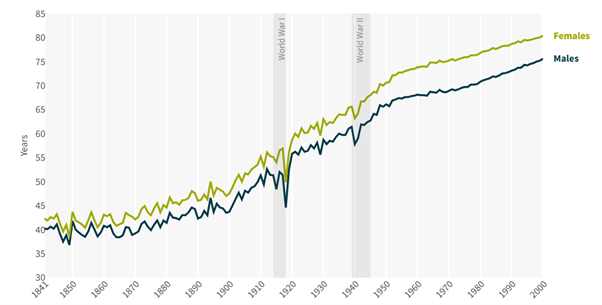

The below graph demonstrates the life expectancy of men and women at birth, between 1841 and 2000.

Source: The King’s Fund

As you can see, aside from some temporary dips caused by the world wars, the average life span of men and women in the UK has risen steadily over time.

This trend is likely to continue in the future as the Office for National Statistics (ONS) reports that a 50-year-old woman has an average life expectancy of 87, while a man of the same age could live to 84. Further to this, a 50-year-old woman has a 7.8% chance, and a man has a 4.6% chance, of living to 100.

Meanwhile, a 20-year-old woman has a 14.5% chance of reaching 100, while a man of the same age has a 9.8% chance.

As such, you could be likely to live longer than previous generations, especially if you live a healthy lifestyle.

48% of people are concerned that their retirement savings will run out

If you retired at the State Pension Age of 66 (increasing to 67 and eventually 68 for those born after 5 April 1960), you could live for around two decades in retirement. This assumes you have the average life expectancy for a 50-year-old.

What’s more, if you live a healthy lifestyle, you could live longer than average.

It’s important that you consider whether you are likely to have enough in your retirement pot to fund your desired lifestyle for this long. Unfortunately, if you prioritise your physical longevity without thinking about your financial plan too, you might face a shortfall, and you wouldn’t be alone.

Indeed, according to IFA Magazine, a survey found that 48% of people are concerned their savings won’t last through retirement.

If you face the same situation, you may have to make sacrifices to your lifestyle. Additionally, you may not have as much wealth to pass to your loved ones when you’re gone.

Living longer could mean you’re more likely to require care in later life

While life expectancy is rising, healthy life expectancy – the number of years a person lives in good health – has fallen.

Figures from The King’s Fund show that between 2020 and 2022, average healthy life expectancy was 62.4 years for men, meaning they may spend 16.4 years in poor health. Meanwhile, women could spend an average of 20.1 years in poor health.

Since the period between 2011 and 2013, healthy life expectancy has fallen by 0.8 years for men and 1.3 years for women.

Consequently, even if you live for longer, you might spend longer with health issues, and this could mean that you’re more likely to need expensive care in the future.

If you don’t consider your financial longevity, you may find it difficult to pay for care costs and, in some cases, may be forced to sell your home. You could also spend much of your retirement pot, meaning your beneficiaries may receive a smaller inheritance after you pass away.

A robust financial plan could ensure you’re able to fund your lifestyle in retirement

You may want to make changes to your lifestyle to improve your health and potentially increase your lifespan. While you’re making these improvements, it’s important that you consider your financial longevity too.

We can use cashflow modelling software to determine how long you might be able to fund your dream lifestyle for. If you’re concerned about a shortfall in your savings, we can explore ways to increase the value of your retirement pot.

Get in touch

If you want to find ways to improve your financial longevity, we can help.

Please contact us at hello@ardentuk.com or call or WhatsApp us on 01904 655 330. As an award-winning financial advice company with advisers included in the 2024 VouchedFor Top Rated guide, you can be sure that we’re a bona fide company providing excellent advice and high-quality service.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate cashflow planning or estate planning.