As the cost of living soars, headlines like the Guardian’s “Bank of England warns of longest recession in 100 years as it raises rates to 3%” might be cause for concern. According to the report, the UK’s central bank has warned that the British economy faces a “very challenging outlook”, which could result in a recession that lasts until the middle of 2024.

It’s likely that you have already seen your household expenditure rise thanks to the soaring cost of food, other goods and energy prices in 2022. With that in mind, you may now be wondering what a recession might mean for your finances, and steps you could take to ensure your money weathers the storm.

If so, read on to discover three ways your finances may be affected if Britain does fall into a recession as predicted, and three actions you could take to help protect your wealth.

1. Interest rates could continue to rise

According to the Office for National Statistics, in October 2022, inflation stood at 11.1%. Historically, when inflation reaches the level it has in 2022, interest rates are increased to tackle one of the main drivers of it: consumer demand.

Higher interest rates means that the cost of borrowing increases, which means the monthly repayment of mortgages, for example, increases. As a result, household disposable income reduces and with it, consumer demand.

According to the Scotsman, the Bank of England (BoE) has warned that inflation could peak at 13.3% and it would not rule out further interest rate hikes. As a result, it’s likely the interest rates could increase further, which could push up the cost of monthly repayments for homeowners with some types of mortgages.

Talking to your mortgage provider to see if they would offer you a fixed-rate deal might be a shrewd move. It could help you avoid an unwanted increase in your repayments and allow you to budget more effectively.

2. Investments could become more volatile

While a recession may cause economic turbulence if you have investments, it’s worth keeping in mind that the stock market and the economy do not always move in sync. During the pandemic, for example, many equities saw significant increases while nation economies around the world struggled.

That said, if a recession happens and your investments suffer a downturn in value, be careful of making a knee-jerk decision to sell that you later regret. This is because selling your shares could turn a paper loss into an actual loss, and deprive your money of the chance to recover when the market bounces back.

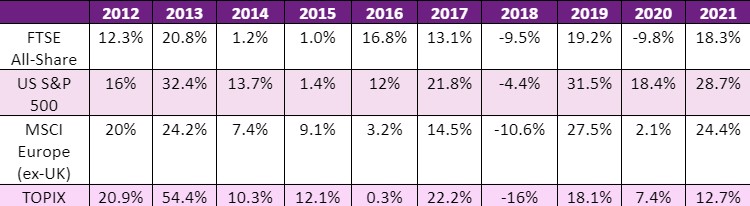

To demonstrate this, consider the following table that shows the annual return of some major stock indices in the 10 years leading up to 2021.

Source: JP Morgan, FTSE, MSCI, Refinitiv Datastream, Standard & Poor’s, TOPIX, J.P. Morgan Asset Management. All indices are total return in local currency, except for MSCI Asia ex-Japan and MSCI EM, which are in US dollars. Past performance is not a reliable indicator of current and future results. Data as of 31 January 2022.

As you can see, with one or two exceptions, stock markets tended to produce positive annual returns. That said, in 2018 and 2020 the FTSE All Share experienced downturns.

If you sold equities that were in the FTSE All Share during these downturns, you would have missed out on the subsequent growth in the following years. Please remember, past performance is no guarantee of future performance.

If you do not have investments, you may want to consider investing during a recession as it may provide greater growth potential. Put simply, if the stock market drops due to economic uncertainty, your money will buy more investment units, which could boost your money’s future growth potential.

3. Your financial security might be at risk

One of the impacts of a recession could be job losses. As consumers spend less money while overheads potentially increase, businesses may look to reduce the number of staff they have to keep the firm afloat.

According to the BBC, in November the unemployment rate was the lowest for 50 years but is expected to rise to nearly 6.5% by 2025.

While the chances of losing your job may be slim, you might still want to consider topping up your “emergency fund” just in case your employer goes out of business. An emergency fund is money in an easily accessible account that you can use to meet your financial obligations if you lose your income.

This could be due to redundancy or the diagnosis of a long-term illness. Typically, you should have three to six months’ worth of total household expenditure in the account, although this will vary depending on your circumstances.

Additionally, you might want to consider paying off debts, especially credit cards as these can be expensive. You might also want to consider financial protection, which could provide an income or lump sum if you are made redundant or diagnosed with an illness.

Get in touch

If you would like to discuss how a recession may affect your finances and wider wealth, please contact us on hello@ardentuk.com or call 01904 655 330.

As an award-winning financial advice company that was a 2022 VouchedFor Top Rated firm, you can be sure that we’re a bona fide company providing excellent advice and high quality service.

Please note

This blog is for general information only and does not constitute advice. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.