First introduced in April 1999, ISAs have become a popular savings and investment vehicle thanks to their tax efficiency.

Saving in a Cash ISA or investing in a Stocks and Shares ISA could be an important part of your financial plan as you build wealth for later life. As you approach retirement, you may consider maximising contributions to your ISA to grow your pot as much as possible.

Indeed, according to the Actuarial Post, 3.8 million people aged between 55 and 64 have ISAs worth an average of £38,257.

However, despite the tax benefits they offer, an ISA may not be the most suitable place for your wealth if you’re over 55. This is because your pensions could help you generate more growth than an ISA, and you can access your pension savings from age 55 (rising to 57 from 2028).

Read on to learn why you might want to prioritise pensions over ISAs if you’re over 55.

ISAs and pensions both offer significant tax benefits for savers but there are important differences

ISAs and pensions are both tax-efficient options for savers. However, there are some important differences between them that you may want to consider.

You don’t pay Income Tax, Dividend Tax, or Capital Gains Tax (CGT) on interest or investment returns generated on wealth within your ISAs.

Additionally, you won’t pay Income Tax when withdrawing funds from your ISAs. You can also access your savings at any time.

In the 2024/25 tax year, you can pay up to £20,000 into your ISAs. You may want to use as much of this “ISA allowance” as possible when saving or investing for the short to medium term.

In comparison, when you invest in a pension, you also don’t pay Income Tax, Dividend Tax, or CGT on interest and returns generated by that wealth. However, you may pay some tax when you access your savings.

In 2024/25, you can take the first 25% of your pensions as a tax-free lump sum. You can take this all at once or as several smaller amounts.

Any additional wealth you draw from your pensions is taxed at your marginal rate of Income Tax. Also, you can’t normally access your pensions until you’re 55.

Consequently, if you’re under 55 and plan to save cash for an emergency fund or invest for the medium term, your ISAs may be more beneficial than your pensions. This is because you can access your savings more easily if you need to.

However, if you’re 55 or older and can access your pensions, you may want to prioritise them over your ISAs. This is because the tax relief you can receive (more on this in a moment) could mean you’re better off than you would be if you paid into an ISA, even if you pay tax when drawing from your pensions.

Tax relief could mean that you would be better off if you contributed to a pension instead of an ISA

On the face of it, an ISA may appear to be a better choice than your pensions for short- to medium-term savings because you can draw funds from an ISA without paying tax. Conversely, you might pay some tax on income from your pensions.

However, it’s important to consider the tax relief you can benefit from when contributing to a pension.

When you pay into your pension, you typically receive 20% tax relief. You may also be able to claim an extra 20% or 25% through self-assessment if you’re a higher- or additional-rate taxpayer.

You can receive this tax relief on your contributions up to your “Annual Allowance”. This is the total amount you can tax-efficiently contribute to your pensions each tax year. In 2024/25, this stands at the lower of £60,000 or 100% of your earnings.

Your Annual Allowance may be reduced if your earnings exceed certain thresholds.

The tax relief on your contributions could mean that you’re better off paying into a pension, despite the Income Tax you could pay when drawing an income.

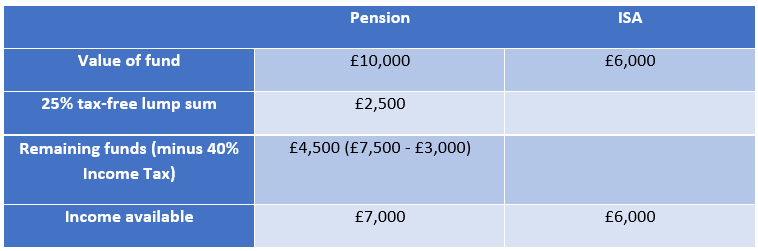

For example, if you’re a higher-rate taxpayer, you could contribute £8,000 to your pension. Assuming you have sufficient remaining Annual Allowance, you would then automatically receive 20% tax relief (£2,000), giving you a total pot of £10,000.

You could then claim another 20% tax relief (£2,000) back through self-assessment. This means the total “cost” of a £10,000 contribution is £6,000.

The following table shows the difference in income you could generate depending on whether you paid that £6,000 into your pension or an ISA. The figures discount fees and assume no growth, and also that you have a sufficient amount of your 25% pension tax-free lump sum remaining.

Source: Actuarial Post

As you can see, contributing the £6,000 to your pension would mean that you could draw £1,000 more income after tax than you would from an ISA.

Also, if you’re still working, you may benefit from employer contributions on top of your own. This could mean that you’re able to build wealth in your pensions faster than you would in an ISA.

Consequently, you might want to prioritise using as much of your Annual Allowance as possible before contributing to ISAs.

Bear in mind that if you flexibly access a defined contribution (DC) pension, you are affected by the “Money Purchase Annual Allowance”. This effectively reduces your Annual Allowance to £10,000.

In this case, you may want to seek professional advice to determine the most tax-efficient ways to build your savings.

Your pensions are normally exempt from Inheritance Tax

Building savings to fund your lifestyle in retirement is likely a priority for you as you get older, and you might also consider how you will pass wealth to your loved ones when you’re gone.

This is another potential reason to prioritise pensions over ISAs because the wealth in your pensions is normally free from Inheritance Tax (IHT), while ISAs are not.

If you pass away before you’re 75, your beneficiaries won’t normally pay tax when drawing an income from your pension either. However, if you die after 75, they may pay Income Tax at their marginal rate.

You may want to consider the potential estate planning implications when deciding between saving in a pension or an ISA. That said, IHT rules can be complex and any mistakes could be costly for your loved ones, so you may want to seek professional advice.

Get in touch

We can help you find the most tax-efficient ways to build wealth for later life.

Please contact us at hello@ardentuk.com or call or WhatsApp us on 01904 655 330. As an award-winning financial advice company with advisers included in the 2024 VouchedFor Top Rated guide, you can be sure that we’re a bona fide company providing excellent advice and high-quality service.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate tax planning.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.