According to a recent report by the Independent, inflation in August jumped by the highest level in one month since records began, rising from 2% to 3.2%.

Inflation is the rise in cost of goods and services, and it has the potential to reduce the value of your client’s wealth in real terms, as £1 in the future could buy less than it would do today.

The Bank of England (BOE) calculates that you’d have needed £131 in 2020 to have the same spending power as £100 in 2010, due to an average inflation rate of 2.7% a year during the period.

What’s more sobering is the BOE warning that inflation could reach 4% by the end of 2021, something that could have implications for any clients with cash savings. Read on to discover why inflation is rising, why your clients need to be aware of its potential impact and how a financial planner could help.

Inflation is rising because of increasing fuel and food costs

The Office for National Statistics, which publishes the UK’s inflation figures, showed that the increase between July and August 2021 was due to the rising price of transport, fuel, food and drink.

Besides these, the higher prices in restaurants and hotels were also seen as a contributor as the UK continues to return to a more normal lifestyle. This need not be an issue if your client’s wealth is rising in line with inflation, although today’s historically low interest rates on savings accounts probably means this is unlikely.

Low interest rates are typically not keeping up with inflation

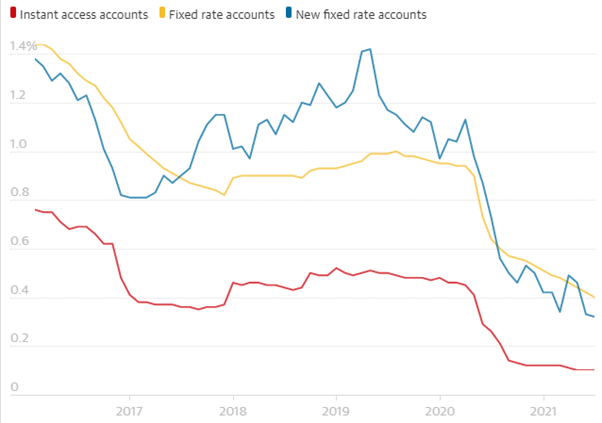

The following graph tells an interesting story. It shows the average interest rates offered for three types of savings accounts in the five years up to August 2021. As you can see, the average rate for all types of cash saving is now less than 0.5%.

Source: the Guardian

The Guardian also explains that, in August 2021, when inflation was 3.2%, around 12% of easy access savings accounts were offering just 0.01% in interest. This means that if your client’s money was in one of these accounts, it would be reducing in value in real terms.

Investing might help inflation-proof your client’s money

The good news is that there may be a way to inflation-proof your client’s wealth. By investing their money, they could be exposing it to greater potential growth than savings accounts are currently offering.

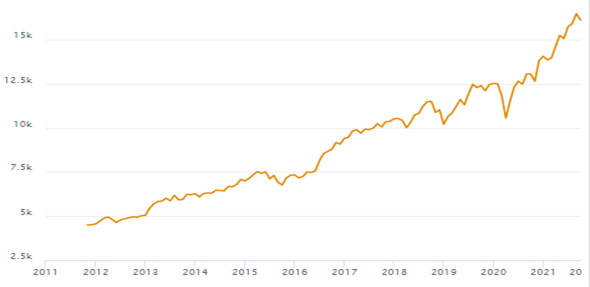

The graph below shows the performance of the MSCI World Index during the last 10 years. The index tracks the performance of a basket of companies from developed countries across the world.

Source: MSCI

As you can see from the left-hand axis, which represents the value, it has increased significantly during that time, despite downturns along the way. This is in contrast to the first graph showing the decline of average interest rates on cash savings.

Please remember, investing should not be entered into lightly and your clients should see it as a long-term venture. They may also receive less than they originally invested, depending on when they decide to access the investments.

Speaking with a financial planner could be critical

When your clients work with a financial planner, you’ll have peace of mind that their situation and any possible investment will be thoroughly researched. This helps ensure the right investment is found for your client, and they will feel comfortable with any decision they make.

A financial planner will take the time to fully understand your client’s situation to make sure investing to potentially inflation-proof their wealth is the right thing to do. The planner will also ensure that any investment dovetails into their wider wealth as tax-efficiently as possible.

This means helping your clients understand two key elements of their investments, which are:

- Cost: your client might want to keep the charges associated with the investment to a minimum or may prefer the idea of paying more for a fund that’s overseen by a fund manager. A planner will help them understand which option may be better and why.

- Attitude to risk: your clients will have peace of mind that any investment they make provides the potential growth they are looking for, while offering an agreed level of protection should the market take a downturn.

A financial planner could also help your client monitor the performance of their investments, and provide options if they are not performing as well as hoped. This could help your client avoid a knee-jerk decision that they later regret.

Get in touch

If you have clients who could benefit from inflation-proofing their wealth, we would be happy to help. Either email hello@ardentuk.com or call us on 01904 655 330.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Please note, this article only deals with England and our understanding of English Law.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.