The last few years have been incredibly disruptive, with several significant events affecting the global markets.

As the world recovered from the Covid-19 pandemic, the surprise invasion of Ukraine caused another huge wave of uncertainty. A misjudged mini-budget also shook faith in UK markets, and households across the country have been dealing with high inflation and rising living costs.

All this disruption could be bad news for investors, and you may have experienced some losses in the last year. Indeed, the Guardian reports that the FTSE 250 fell by 19.7% in 2022, while Germany’s DAX index lost 12.3% and France’s CAC index dropped by 9.5%.

A market downturn often sparks fear among investors, and it is in a climate like this that people start talking about “wealth preservation”, aiming to protect their investments from losses.

While this may seem like a sensible approach, the idea of wealth preservation may not be as effective as it seems. In fact, it could make it more difficult to achieve your long-term financial goals.

Read on to learn more about wealth preservation and why it may not be the best way to deal with market volatility.

Wealth preservation means moving towards investments with reduced risk

A wealth preservation strategy is normally born from a desire to regain control during a period of volatility.

Investors may decide to move wealth out of stocks and shares and into cash or fixed-interest options such as bonds instead. These are considered less risky and the belief is that a guaranteed return, albeit a smaller one, is preferable to potential stock market losses.

Ultimately, wealth preservation is a shift in mindset, so investors prioritise avoiding losses and maintaining the value of their wealth instead of actively seeking growth.

By doing this, they believe that they are avoiding risk and protecting their wealth. When the markets stabilise, they may adopt a growth mindset once again.

Unfortunately, there are several key problems with this approach, and it could lead to less favourable outcomes in the long term.

You risk locking in losses by changing your approach now

Historically, market volatility is a short-term challenge. Given enough time, the markets tend to recover and investors see continued growth.

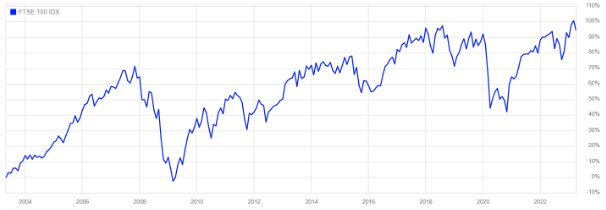

To demonstrate, the following graph shows the performance of the FTSE 100 between 5 April 2003 and 5 April 2023:

Source: London Stock Exchange

In that 20-year period, the world experienced the 2008 financial crisis and a global pandemic. Yet, the FTSE 100 still grew by almost 95% in that time.

You can see from the graph above that the stock market dipped significantly during times of turmoil.

If investors had panicked and taken their money out of the stock market during these periods of volatility, they would have missed out on future gains when the markets recovered and continued growing.

Effectively, they would have locked in their losses by selling investments at a reduced price because they feared further losses in the future.

You risk falling into this trap if you adopt a wealth preservation strategy and take your money out of the markets during this current period of volatility.

Instead, it may be more sensible to hold your investments and wait until they recover, so you can potentially benefit from growth in the future.

While past performance does not guarantee future returns, historical data suggests that this may be likely.

Wealth preservation may not beat inflation

Wealth preservation aims to stop your investments from losing value when stock markets fluctuate. Yet, if you adopt this strategy, your money could lose value in real terms, particularly during a period of high inflation.

According to the Office for National Statistics (ONS), inflation was 4.6% in the 12 months to October 2023.

Let’s consider how this compares to the potential returns from the low-risk options that wealth preservation strategies typically rely on.

For instance, the highest five-year fixed-term Cash ISA interest rate, according to MoneySavingExpert, was 4.95% on 15 November 2023.

Fixed-rate bonds may perform slightly better, with Moneyfacts reporting that the best rate available on 15 November was 5.9%.

However, both of these options offer a return that only just beats the rate of inflation – and actually lag behind the rate of inflation in the 12 months to September 2023, calculated at 6.7%. As a result, your wealth could lose value in real terms if you move it out of the stock market and into these “safer” options.

Conversely, IG reports that the average total return, including reinvested dividends, from the FTSE 100 between 1984 and 2022 was 7.4%.

As such, investing in the stock market could be more likely to generate growth that beats inflation.

Sustained growth can be an effective way to protect your wealth

If you move your wealth into cash savings or bonds, you may not see returns that are high enough to combat inflation. Additionally, by selling investments during a period of volatility, you may be locking in losses and missing out on future returns.

As a result, you are likely not preserving your wealth because it could be losing its value in real terms.

Conversely, if you take a long-term approach and maintain your current strategy, your investments could well recover. Additionally, the long-term growth you see from investing in the stock market could be more likely to protect your wealth against the effects of inflation.

That’s why it is important to keep your long-term goals in mind and trust in your financial plan, particularly during a period of market volatility.

Get in touch

We can offer reassurance and peace of mind during times of turmoil, so you can stick to your financial plan.

Please contact us at hello@ardentuk.com or call 01904 655 330. As an award-winning financial advice company that was a 2022 VouchedFor Top Rated firm, we’re a bona fide company providing excellent advice and high-quality service.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.