When deciding how to hold and grow your wealth, you may consider the relative benefits of holding cash versus investing. Data shows that UK adults are more likely to hold their wealth in cash than invest in the stock market.

According to Finder, 29% of UK adults have at least one Cash ISA, while only 15% have a Stocks and Shares ISA.

This may be because investing in the stock market exposes you to potential losses. Meanwhile, saving in a cash account is simple, providing regular interest without the need to worry about stock market fluctuations.

However, cash may be less likely to beat inflation, making it more difficult to reach your savings goals in the future.

Read more: The dangers of holding too much cash in a world of stubborn inflation

Investments, on the other hand, could offer significant growth, especially when you hold them for a long period.

Read on to learn what historical data tells us about your potential returns from cash and investments.

Investments could provide far greater returns over a long period

To compare the potential returns you might see from cash savings and investments, it’s useful to consider historical average growth.

Figures from This is Money show how £10,000 would have grown, depending on whether you held the funds in a Cash ISA or invested through a Stocks and Shares ISA.

The data tracks returns between 1998 and 2024, showing that investing delivered significantly higher growth.

| Year | Value of Cash ISA | Value of Stocks and Shares ISA |

| 1998 | £10,000 | £10,000 |

| 1999 | £10,520.25 | £13,050.83 |

| 2003 | £12,578.36 | £9,535 |

| 2008 | £15,885.52 | £12,359.85 |

| 2013 | £16,280.16 | £22,154.50 |

| 2018 | £16,617.04 | £36,535.09 |

| 2023 | £17,793.30 | £64,956.49 |

| 2024 | £18,695.34 | £77,826.24 |

Source: This is Money

As you can see, the Cash ISA grows steadily, increasing in value by around £8,000. In comparison, the Stocks and Shares ISA sees more fluctuations.

For instance, investment growth outstrips cash in the first year, but falls below the original £10,000 the next. By 2013, however, investments once again outperform cash.

Across the full period, the growth from a Stocks and Shares ISA would have been far greater than that of a Cash ISA.

This reveals an important difference between cash and investing. In the short term, cash might offer more reliable returns, as your wealth is not vulnerable to stock market fluctuations. Over the long term, however, stock markets typically bounce back and continue growing at a much faster rate than cash.

Your chances of making a loss decrease the longer you hold your investments

As well as increasing your potential returns, holding investments for a long period could reduce your chances of making a loss.

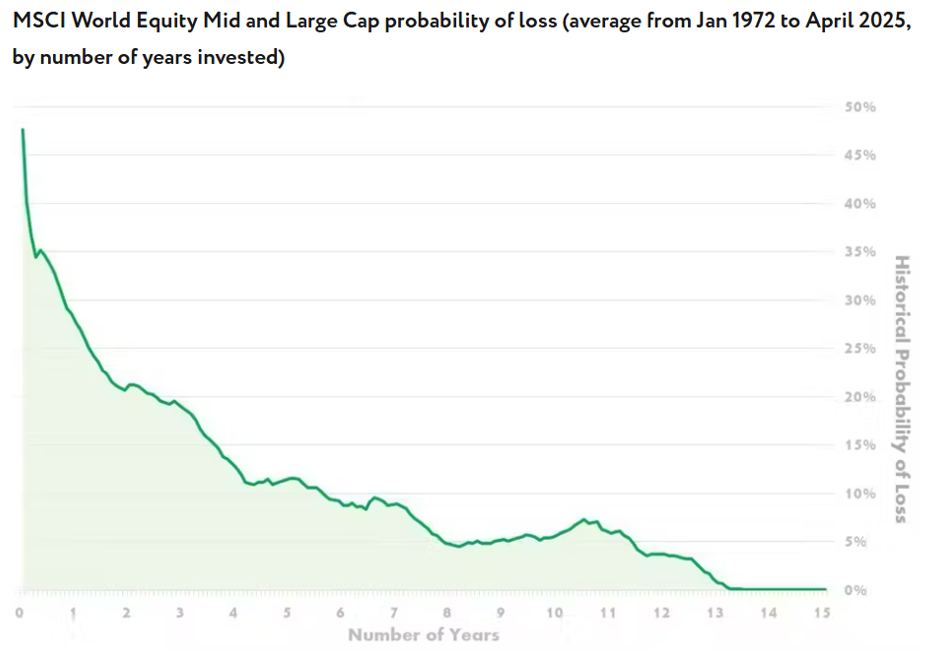

For example, consider this data from Nutmeg, which tracks the probability of losses from the MSCI World Equity Mid and Large Cap index between January 1972 and April 2025.

Source: Nutmeg

In the first year, you would have had around a 50% chance of losing money on your investments. But after just three years, that chance dropped to below 20%.

Had you held your investments for 13 years or more, the probability of making a loss fell to zero.

As such, this data demonstrates that if you plan to build wealth for the future – holding it for five years or more – investing could be a more effective option. You may see far more growth and investing might not be as risky as you thought, provided you take a long-term approach.

3 important factors to consider when building an investing portfolio

While investing is a crucial part of your financial plan, any mistakes when building and managing your portfolio could be costly.

To increase your chances of success, you may want to consider the following factors.

1. Your specific investing goals

Before you invest, you may want to think about your specific goals. For example, you might want to build wealth for retirement, purchase a second home, or generate a regular income from your investment portfolio.

Understanding your reasons for investing helps you decide on which kinds of investments might be best suited to you.

If you’re planning to invest until you retire, you may opt for riskier investments that fluctuate often but could offer significant long-term returns.

However, if you want your portfolio to support your income now, you may explore dividend-paying investments or a buy-to-let property.

Clarity about your goals also means you can track your progress and see whether your investment portfolio is working for you.

2. Your attitude to risk and appetite for loss

Your attitude to risk is another key factor that will determine the kinds of investments you choose.

You might find that constant market fluctuations make you anxious, and you’d prefer the security of steady growth, even if it means lower returns. Conversely, you may be happy leaving your investments during periods of market volatility, comfortable in the knowledge that you should see long-term growth.

Additionally, you’ll need to consider your appetite for loss – how much you could comfortably afford to lose if your investments fall in value.

3. How well-diversified your portfolio is

Diversifying your investments helps balance risk and reduce the chances of making a loss. Instead of placing all your wealth in one or two investments, you may want to spread your funds across a variety of investment products, industries, and geographical regions.

That way, gains from some investments might offset losses from others. Also, certain industries or regions might be insulated from global events affecting the value of other investments.

Get in touch

We can support you in building a well-diversified investment portfolio, suited to your unique goals.

Please contact us at hello@ardentuk.com or call or WhatsApp us on 01904 655 330. As an award-winning financial advice company with advisers included in the 2025 VouchedFor Top Rated guide, you can be sure that we’re a bona fide company providing excellent advice and high-quality service.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.