As we head towards the third year of life with Covid, there is still plenty of economic uncertainty for the world to deal with. Many countries face increasing inflation and rising interest rates, both of which have affected the way investments performed in January 2022.

According to a recent article in the New York Times, the S&P 500 index dropped 5.3% in January 2022 and the tech-heavy Nasdaq fell 18.5% from its highest point in 2021. Quite a contrast to 2021, which saw the S&P 500 rise 26.9% and the Nasdaq gain 21.4% over the year.

That said, the article also explains that Wall Street is predicting better times ahead in 2022.

It was slightly better news for the FTSE 100 in January 2022. According to Proactive Investor, it finished around 1% up on the month.

So, what is happening with stock markets and why has 2022 got off to such a shaky start? Read on to find out, and how you could protect your wealth during this volatile time.

In 2021, inflation reached levels not seen for decades

As countries around the world kick-started their economies in 2021, many faced supply chain problems created by the Covid lockdowns. This, together with labour shortages and a sharp increase in energy prices, resulted in an increase in the cost of producing goods. Consequently, this pushed up prices and resulted in higher inflation.

In America, inflation reached 7% in December 2021, the highest level for four decades.

The Office for National Statistics revealed that inflation in the UK reached 5.4% during the same period – a 30-year high. According to the Bank of England (BoE), inflation could exceed 7% by mid-2022, something that prompted the Bank to increase its interest rate to 0.5% in February 2022.

High inflation made the markets more volatile in 2022

Inflation can reduce economic growth because of increased costs, and this can affect the confidence of investors. That said, this is only one reason stocks and shares got off to a shaky start in 2022; there are others as well. These include:

Escalating crisis over Ukraine

The tensions over Russia and Ukraine have added to the volatility of global stock markets. A recent report by the Guardian reveals that fears of a military conflict over Ukraine resulted in global stock markets dropping significantly in January.

Covid pandemic

While the Omicron variant turned out to be less severe for most people, the market is still nervous about new variants arising in the future. This might cause further lockdowns, supply chain problems, and disruptions to the world’s economic recovery.

Higher bond yields

Bonds are government debt that pay interest. Usually, they are less risky than stocks and shares, yet provide greater potential returns than savings accounts.

While bonds had fallen out of favour in recent years because of poor returns, higher yields in 2022 have made them a more attractive option for investors.

Interest rate rise

Interest rates are expected to continue rising in 2022. According to the Times, experts predict the BoE will increase its rate to 1.25% by the end of the year as it attempts to bring inflation more in line with its 2% target.

This creates uncertainty within the markets because economic growth can be stifled by rising interest rates. This is because the cost of borrowing goes up, meaning loans to expand a company become less affordable.

It could also reduce consumer spending if, for example, mortgage repayments increase and households have less disposable income.

It’s time in the market that counts, not “timing” the market

While all of these points make for sombre reading, there is some good news. If you see investing as a long-term venture, you’re more likely to ride out any downturn in the market and potentially enjoy future growth when markets later recover.

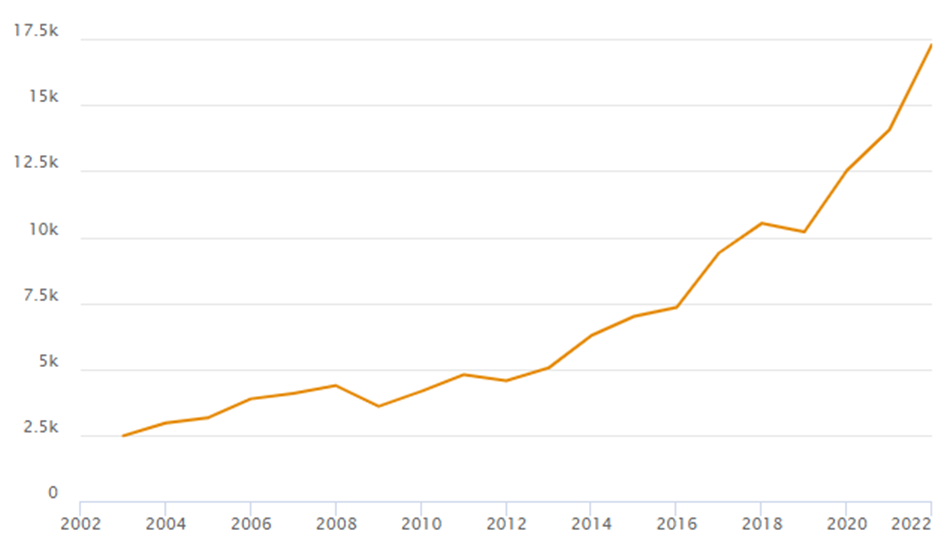

To demonstrate this, consider the following graph that shows the performance of the MSCI World Index between 1 January 2020 and 1 February 2022. The index tracks a basket of companies from 23 developed nations.

Source: MSCI

As you can see from the values on the left-hand axis, while the index enjoyed significant growth during the period, there were several downturns along the way – for example, as the first wave of Covid lockdowns hit in spring 2020. Investors that sold their investments during these downturns missed out on the subsequent growth that followed.

That’s why you might want to consider remaining patient when the market drops and wait for it to recover. That said, always remember that with investments, previous performance is no guarantee of future performance.

Get in touch

If you’re a client of Ardent, you’ll already know we aim to provide you with peace of mind when it comes to investing.

One way we do this is by carefully selecting investments that shield your wealth from a market downturn as much as possible. This means we assess the risk contained within the investment and ensure it matches your circumstances and the level of risk you are prepared to take.

That said, if you do have any questions about the market’s performance in 2022 and your investments, please get in touch, as we’d be happy to talk.

If you’re not yet a client and would like to discuss your wealth, investments or this blog, please contact us on hello@ardentuk.com or call 01904 655 330. As award-winning specialists in financial planning, we’ll create a strategy that will help you get the best from your investments, providing you with peace of mind whatever the market is doing.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.