There has been a surge in DIY home investors since the beginning of the Covid-19 pandemic. Twinned with record-low interest rates on savings accounts, many people turned to investing as a way of trying to increase the return on their hard-earned savings.

New, easy-to-use investment platforms allow anyone to get involved, no matter their experience. And get involved they did, with This is Money reporting that all major investment platforms recorded an increase in trades and users through 2020.

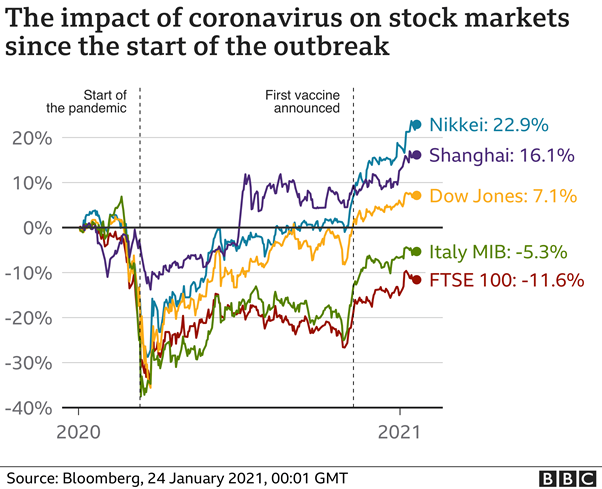

The pandemic not only had an effect on our investment habits, but on the markets themselves. As the pandemic hit, stock markets across the world suffered falls, and central banks slashed their interest rates. Since then, most stock markets across the world have risen back to pre-pandemic levels, with some managing to grow even higher.

The graph below from Bloomberg, published by the BBC, shows the initial effect that the pandemic had on markets across the world up to January 2021.

But such market volatility has come with vital lessons for us all. Whether you are a brand-new retail investor or a seasoned veteran with market acumen, there are always lessons to learn from volatile times such as this. Read on for five lessons in investing we learned from the Covid-19 lockdown.

1. The markets don’t always follow the economy

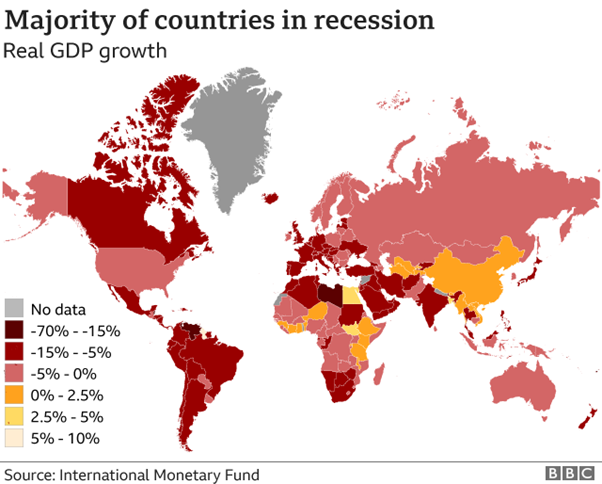

The performance of the markets doesn’t always directly reflect the performance of a country’s economy. Thanks to the pandemic, GDP across the world fell during 2020, but stock markets didn’t follow the same trend.

After some initial drops around March, markets around the world steadily recovered, with many reaching higher than pre-pandemic levels by the end of the year. Take the Nikkei 250, for example, which was 22.9% higher in January 2021 than in January 2020, despite Japan’s economy shrinking by 4.8% over the same period. The Nikkei 250 reached its highest level in 30 years in February 2021.

The map below from the BBC shows the real GPD growth across the world in 2020, with the majority of the world’s major economies suffering losses through the year. The only major economy not to contract in 2020 was China.

When compared to the stock market line graph, it’s clear that markets and the economy are not always aligned.

A good example is the housing market. Despite the UK suffering its biggest recession in decades, house prices rose by 13.4% in the year to June – the highest growth in 17 years.

2. Panic selling can cost you dearly

When you notice your investments dropping in price, the natural, emotional response can be to sell. Behavioural science tells us that it’s a natural reaction to want to avoid losses.

As the graph above shows, stock markets fell sharply in early 2020. However, had you sold at that point, you would have missed all the growth that markets have experienced since that time – including some global stock markets hitting record highs. Rather than locking in losses, patience would have been rewarded.

There’s an old adage that it’s “time in the markets, not timing the markets” that counts. This suggests that leaving investments untouched and avoiding panic selling is often a solid strategy.

Schroders have run the numbers and found that if you had invested £1,000 in the FTSE 250 in 1986 and left the investment untouched for 35 years, it might have been worth £43,595 in January 2021.

If you’d tried to time the market and you’d missed out on just the 30 best days for the FTSE 250, that investment would be worth just £10,627.

Stock markets inherently have good and bad days. Seeing your prices start to sink on a bad day does not mean it’s time to panic and sell. Many of a market’s best days can come immediately after the worst, so panic selling on a downturn could severely limit your returns.

3. You should always expect the unexpected

The pandemic itself was an entirely unpredictable event, and in many ways the economic situation remains uncertain. Are cases going to surge again? How well will global economies recover? There are many questions left over from the worldwide standstill.

Not being financially prepared for such unexpected events can be a nightmare, putting you under unnecessary stress, both mentally and financially. It’s therefore important that you have a sufficient emergency fund set aside before you think about investing.

Three months’ worth of living expenses is the recommended minimum for an emergency fund. This should be plenty to cover any urgent costs and provides you with a protective financial cushion should you unexpectedly lose your income.

4. Diversification of investments is key

The classic saying “don’t put all your eggs in one basket” continues to ring true. Diversifying your investment portfolio prevents your returns being tied to a single stock or market performance.

By investing internationally, a stock market crash in Shanghai, for example, won’t have as big an effect on your returns provided you are diversified. Poor performance in one geographical region or sector can be offset by strong growth in another.

For example, in April 2021, while the UK stock market continued to be uncertain, the Dow Jones market in America reached an all-time high, despite the financial turbulence of the year leading up to it. The Nasdaq also hit an all-time high in June 2021.

5. Always invest for the long term

When it comes to investing, experts will typically suggest you consider a time period of five years or more. As mentioned above, time in the market can be an effective method for generating returns.

Statistically, your chances of a making a profit increase over time. Nutmeg have looked at the chances of generating returns from investing over different periods of times, using global stock market data from between January 1971 and May 2020.

If you had picked a day at random during that time and invested for just that one day, you would have had a 52% chance of making a profit. Investing your money for any three-month period during that time would have given you a 65% chance of making a profit.

Investing for one year raises this to 72%, and investing for 10 years raises it even further, to 94%. The longer you remain invested, the higher chance you have to secure a profit. Nutmeg even found that an investor who was invested in the stock market during this period for 13 and a half years at any point, never lost money.

Get in touch

If you’re thinking of making, changing, or selling your investments, make sure you speak to us first. We can help create a plan to ensure you get the best out of your money.

If you would like to discuss your investments, please email hello@ardentuk.com or call us on 01904 655 330.