As 2022 has been a financially challenging year in many ways, it’s not surprising that the stock exchange has been volatile throughout the year. In the wake of the Covid-19 pandemic, Russia’s invasion of Ukraine, soaring inflation and rising interest rates, the stock market has seen many ups and downs throughout the year.

This might suggest that the stock market and economy run in tandem with each other, something echoed by a CNBC article. It reveals that the relationship between the stock market and the economy may be getting closer as more people own shares and business’s future seems to be increasingly dependent on their share price.

That said, the stock market doesn’t always move in the same direction as the economy, as historically it has increased when economies are downbeat and vice versa. If you’re wondering what this could mean for your wealth, read on.

Before you do, let’s look at a commonly used analogy to describe the relationship between the two.

The link between the stock market and economy is like walking a dog

The best way to describe the relationship between the stock market and global economy is that of someone walking a dog, where the economy is the calm walker, and the markets are the excitable dog.

While both move in the same overall direction, the dog tends to race around more, zigzagging as it follows the same general path as the walker. This is because the markets typically react to events in the short-term, even when the events don’t have any long-term significance to the economy.

Because of this, the stock market won’t always directly reflect the economy, something we will look at in more detail now.

Expectations affect how the stock market reacts to news

News about the economy can be good or bad, although what affects the stock market most is whether the news is better or worse than investors expected. For example, positive news about consumer spending will help boost markets as it suggests that the earnings potential of publicly traded companies will increase and push share prices up.

Ironically, bad news can also be good for the stock market and might help boost share prices. An example of this could be news that the level of employment has dropped unexpectedly, which could result in the government responding with monetary and fiscal policies to stimulate the economy.

This could be good news for investors when you consider an article by the Guardian, which suggests Britain could be plunged into a deep and long recession. The fact that the stock market doesn’t always follow the economy could provide welcome news if you’re wondering what this could mean for your investments.

The stock market can rise when economies perform poorly

While the media may be predicting financial doom and gloom in 2023 the markets have the potential to react more positively. To demonstrate this, you might want to consider Britain’s last recession, which took place between April and June 2020 because of the Covid lockdowns.

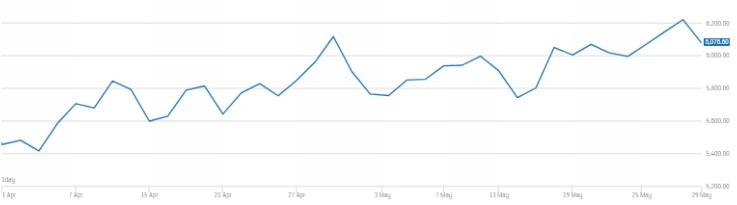

The BBC reveals that while the recession was short, the UK’s economy fell by 20.4%, which was the greatest drop on record. That said, the following illustration provides more positive news.

It shows the performance of the FTSE 100 during the period, the index that tracks the performance of the top 100 companies listed on the London Stock Exchange.

Source: London Stock Exchange

As you can see from the values on the right-hand axis, overall, the index rose significantly in value despite downturns along the way

This is echoed by the 2008 “great recession”, which took the global economy several years to recover from. Yet research reveals that in March 2009 the FTSE 100 started its recovery, and more than doubled in the 10 years that followed.

Consider your long-term investment objectives when the economy struggles

When the economy looks uncertain it’s important to try not to panic if you have investments. One way you could do this is to pay less attention to alarmist headlines in the media, and instead, concentrate on your long-term goals.

Becoming too concerned by media “noise” could result in you selling your investments to limit losses, something you may later regret. This is because you could turn a paper loss into a real one and deprive your money of future growth potential when the stock market later recovers.

It’s worth remembering that historically the stock market has tended to outperform cash, so remaining invested could mean your money enjoys greater growth potential. This is backed up by the 2019 Barclays Equity Gilt Study, which tracked the nominal performance of £100 invested in cash, bonds or equities between 1899 and 2019.

It found that the original £100 would be worth just over £20,000 in 2019 if the money was invested into cash. If it was left in stocks and shares it would have been worth around £2.7 million in 2019.

Furthermore, it revealed that if the money was invested for any two consecutive years it would have had a 69% chance of outperforming cash. If it was invested for any 10-year period, this increased to a 91% chance.

Please note, past performance is no guarantee of future performance.

Get in touch

If you would like to discuss your investments and what the current economic situation might mean for them, please contact us on hello@ardentuk.com or call 01904 655 330. As an award-winning financial advice company that was a 2022 VouchedFor Top Rated firm, you can be sure that we’re a bona fide company providing excellent advice and high quality service.

Please note

This blog is for general information only and does not constitute advice. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The information is aimed at retail clients only.

Investments carry risk. The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.